Do you want to build a house but don’t know where to start? Then you will love this guide. It is the most comprehensive guide to build a house in Brisbane available.

The best part?

We are going to show you the techniques to build a home in Brisbane that are working right now (in 2024).

In short, if you want to construct your own home, you’ll love this guide.

Let’s get started.

1. Build A House Basics

In this chapter, we’ll cover the basics.

First, you’ll learn exactly how to crunch the numbers to determine your price range.

We’ll also explain why your deposit is so important for building a house in Brisbane.

How is building a home different from buying an existing house? When buying an existing home, you purchase the home in one go, and you can move in right away.

On the other hand, building a house involves financing in two different stages:

- A Home loan for the land purchase, and then

- A Construction loan for building the home

The construction of a home in Brisbane takes 4 to 12 months on average, so during this time, you will need to find somewhere else to live.

Why build a home?

There are lots of positives and negatives to building a home.

Building a new home allows you to access the First Home Owners Grant and design your dream home or an investment property. You can claim depreciation benefits over the first few years. However, an existing home will be closer to the city than a new home, as vacant land is rarely in the inner city.

It really comes down to your personal choice and what you want to achieve.

How do you build a home in Brisbane?

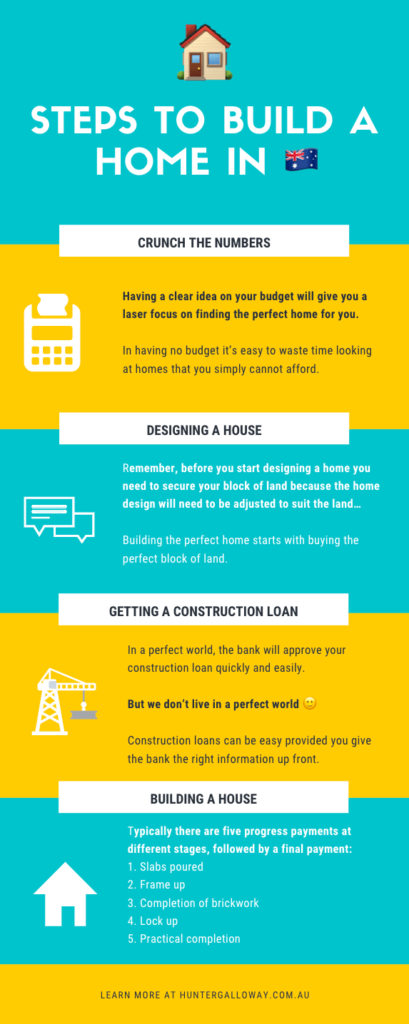

Building a home can be broken down into these simple steps:

How does a mortgage broker help you build a house?

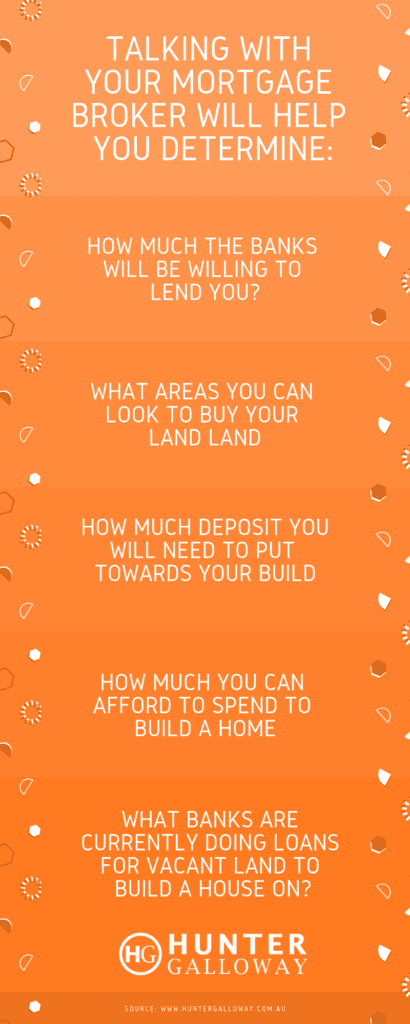

To build a house, you are going to need a loan. But a great mortgage broker can help with much more than just getting a loan.

Specifically, they can help you by:

- Crunching your numbers – helping work out what you can afford to build or if you will need to save some extra money or close a personal loan or credit card before talking to the banks. Having a clear picture of your budget will help you find the perfect block of land and build the right home for you.

- Acting as your own personal finance coach – the best mortgage brokers can help with strategies to save more deposit and set goals so that when it’s time to start building your home, everything is ready to go. They will keep you on track and moving towards your goals of building a home in Brisbane.

- Making sure your loan doesn’t get declined – Did you know that over 40% of loan applications were declined this year? Don’t get your loan declined by applying for a loan through a lender that doesn’t do construction loans. For example, ING and Ubank are two banks that cannot do construction or renovation loans, so your loan will get declined if you try to build a house with them! It is also common for there to be issues with valuations, and a bank might want you to put in extra money at the last minute. Don’t get caught out.

- Guiding you through the build process – The build process can be complicated and involves organising lots of different parties like the real estate agents, solicitors, builders, architects and your accountant. A good Mortgage Broker will help guide you through the process.

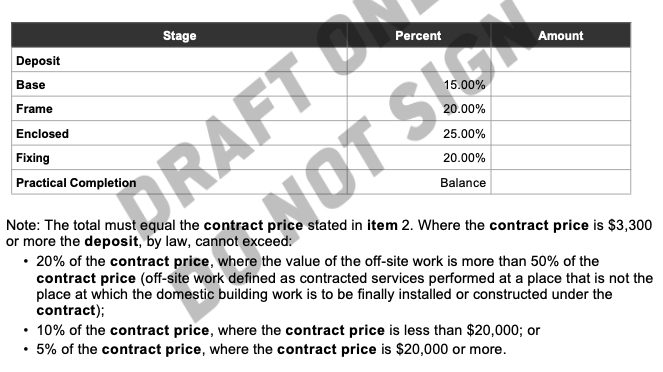

- Completing the staged progress payments – Once you have started building your home, the builder will require 6 stages of payments before the property is completed – The deposit, the base, the frame, lock up, fixing and the completed stage. There is a MASSIVE amount of paperwork involved in arranging payment from the bank to the builder, which the best mortgage brokers will manage for you.

Your Mortgage Broker can also protect you from a VERY common issue when building a house…

…Bank valuations!!!??

In today’s market, it is common for bank valuations to vary from 5-15% between lenders.

To put it another way…

One bank might value your completed home at $500,000.

The next bank might think it’s worth $425,000 (15% less), and YOU would need to find an extra $75,000 to put towards your deposit!!

At Hunter Galloway, we arrange for a bank valuation on the new house and land (sometimes called an on-completion valuation) before we submit a home loan application.

This means you won’t get caught out with a bad valuation -but if you do, we can look at another bank!

But we’ll come back to Construction Home Loans shortly. For now, let us look at home loan terms and general facts you should know. These terms apply whether you are getting a loan to build a house or to buy an existing one.

Home Loan Terms & General Facts

- Interest Rates: This is the rate of interest your bank charges. It is applied monthly but calculated daily, and while it is important to make sure your interest rate is as low as possible, it is also important to consider whether the loan features fit in with your future goals. For example, an introductory interest rate might be cheap for 2 years, but after that term, it will go back up significantly.

- Loan term: The total number of years it will take to repay the loan. This is typically 25 to 30 years in Australia.

- Monthly Repayment: This is the loan repayment you make each month. You can also change the frequency to weekly or fortnightly if you prefer.

- Ability to make extra repayments: Some banks will limit your ability to make extra repayments. For example, a fixed rate could limit you from making extra repayments, hindering your ability to pay down your loan faster.

- 100% Offset Accounts: This is a regular transaction account linked to your home loan. Any money in the offset account reduces the interest you pay on your home loan. If, for example, you had $10,000 in your offset account and your home loan was $100,000, you would only pay interest on $90,000.

2. Time To Crunch The Numbers

Here’s the deal, having a clear idea of your budget will give you a laser focus on finding the perfect block and home for you. Most first homeowners make the mistake of not having a budget when building a home. This makes it easy to waste time looking at homes that you simply cannot afford.

The best way to set a budget is to talk with your Mortgage Broker. Talking with your Mortgage Broker will help you determine the following:

How much deposit do you need to build a house?

In general, it is worth having at least $15,000 in savings to be able to build a house in Brisbane.

But…

There are a few ways to build a house with no deposit.

Let’s look at a few different deposit case studies:

Who? | Deposit Amount | How | Borrowing amount | Is there LMI? | Type |

Sarah | $15,000 savings + $15,000 QLD Great Start Grant | Savings + First Home Buyers Grant | Up to 95% of completed value | Yes (over 80% of completed value) | Standard Home Loan |

Tom | 8-10% of completed value | Savings | Up to 95% of completed value | Yes (over 80% of completed value) | Standard Home Loan |

Lorraine | No deposit + $15,000 QLD Great Start Grant | Gift from Family Member being 10% of completed value | Up to 90% of completed value | Yes (over 80% of completed value) | Standard Home Loan |

Dean | No deposit + $15,000 QLD Great Start Grant | Family Guarantee | Up to 100% of completed value | No | Guarantor Loan |

Let’s look at the case studies in detail.

- Sarah has $15,000 in savings, which is a good place to start, and if you have more than this in savings, that is even better! If you are a first home buyer, you also qualify for an additional $15,000 from the Queensland Government’s Great Start Grant (now called the Queensland First Home Owners Grant] so now you have $30,000!

- Tom has saved a 10% deposit or $50,000 to build his house, which he expects to cost a total of $500,000. There are some additional costs to pay, including stamp duty, legal fees and other moving costs, which he will also need to have enough money in savings.

- Lorraine has no deposit saved but has been renting for the past 12 months and has a family member willing to give her 10% or $30,000 towards her build of $300,000 — plus she qualifies for the Queensland Great Start Grant of $15,000!

Dean also has no deposit, but his parents are willing to go as guarantors, and the bank can take a second loan against their property to lend 100% towards his build, which will cost $350,000. Dean also qualifies for the Queensland Great Start Grant.

Do you qualify for the First Home Owners Grant and rebates?

If you live in Queensland, are building a new home and haven’t owned a property before, you qualify for the First Home Owners Grant.

The First Home Owners Grant (aka the Great Start Grant) is $30,000 cash the government will give you towards your new home purchase.

The best news of all is that you can use this $30,000 towards your deposit!

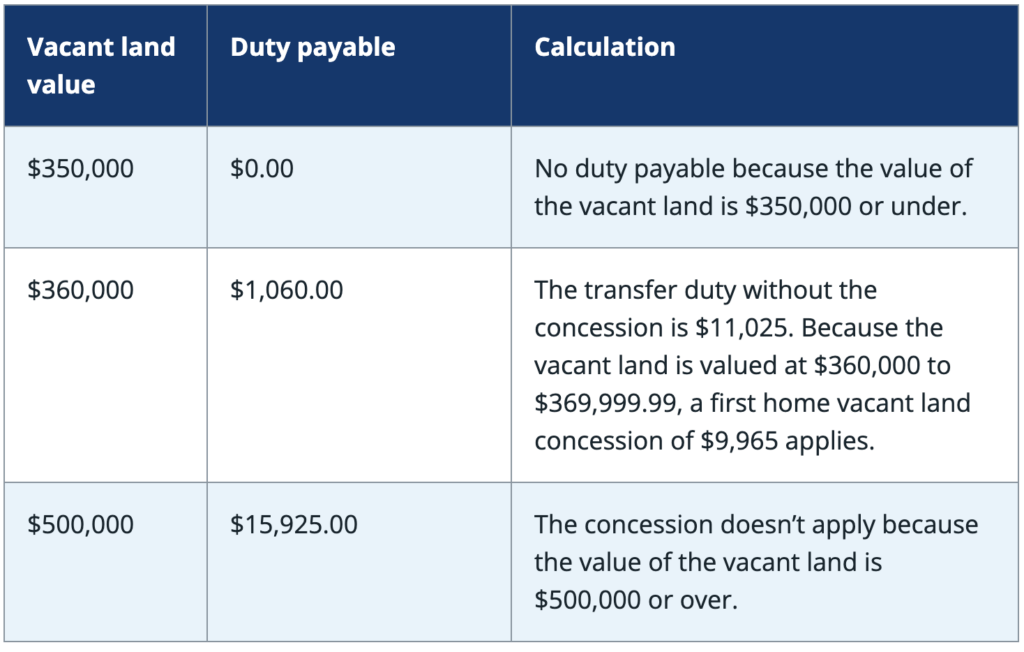

A second benefit to first-home buyers is the stamp duty rebate…

First Home Buyers are entitled to a vacant land concession which is worth up to $10,675!!!

What if you have a bad credit history and aren’t sure if you can apply for a loan?

Bad credit history can be the result of a couple of small mistakes you might have made in the past, and it can affect your overall credit score.

Unfortunately, before a bank is willing to lend you money, they will complete a credit check to see what your credit history has been.

Missing a credit card repayment or being late on a phone bill can affect your credit score.

But don’t worry, if you have had problems in the past, we deal with lenders that can help. However, it is all on a case-by-case basis.

If you aren’t sure what your credit history is, you can get a free report here or get in touch with Hunter Galloway, and we can arrange a credit check for you.

3. Buying Land To Build a Home

Before you start designing a home, you need to secure your block of land because the home design will need to be adjusted to suit the land.

Building the perfect home starts with buying the perfect block of land.

What should I look for when buying a block of land?

The right block of land for you will be different from the right block of land for the next person.

For this reason, it’s important to do your own market research.

Here are a few things to consider when choosing a block of land on which to build a house in Brisbane:

- Work out your own property criteria – Do you want a yard, pool, and lots of space, or are you happy with a small block? Do you want to live close to the city or further out?

- Research the suburb & surrounding community – How long will it take to get to work? What is public transport like? Are there lots of nice cafes and pubs nearby?

- Get a soil test – A soil test (sometimes called a soil survey) will check that there aren’t any dangerous chemicals like asbestos on your land. A soil-bearing test can help determine if your builder will need to spend more on footings.

- Make sure there is good access – Ask a builder if they will have any difficulties with access when bringing in materials, like a driveway off the main road, which can sometimes cause extra costs.

- Look for infrastructure services – Are infrastructure services like stormwater, power and drainage connected? Is there NBN or good telecommunication access to the block of land?

- Check council zoning restrictions – Make sure there aren’t any heritage or character residential restrictions, meaning you can’t put a modern-looking house in an older suburb around Brisbane.

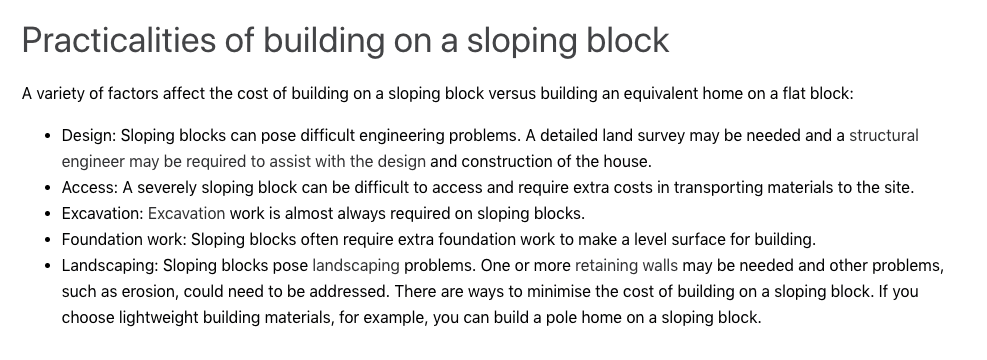

A sloping block of land can be very expensive to build on.

Yes, unfortunately, this is something many homeowners overlook.

Building experts believe that, on average, a slope of up to 1 metre can add 20% to your build costs.

According to a sloping block specialist, a slope of more than 3 metres can become VERY costly, adding a minimum of $50,000 in additional costs.

How do you make an offer on a block of land?

Now, you have completed your preliminary research and are ready to make an offer on a block of land.

What happens next?

Before you lock it down with an offer, it is worth talking to your architect, potential builder or building design sales consultant to check if your dream home will be suited to the land or modified to suit the land.

If they say yes, get a copy of that contract of sale!

What should you do before signing the contract of sale?

The developer (or real estate agent) will give you a copy of the contract of sale.

Get your solicitor to review the contract of sale before you sign it, and confirm the following:

- The contract of sale has your full completed name on it – The details on the contract of sale should match your birth certificate, driver’s licence or passport, and always double-check that your middle name is spelt correctly.

- How long you are going to need for your finance clause – Are you buying just the land and constructing a few months down the track once you have done plans, so you only need the land loan approved now? Or are you buying a house and land package where you want to get the land and construction loan approved at the same time?

For a Finance Clause: More often, 21-30 days for finance is fine. If you are in a competitive market, you may need to consider 14-21 days for finance.

I am ready to sign the contract - do I need to pay a deposit?

Once you have signed the contract of sale, you will need to pay a holding deposit, usually a small amount of $1,000, into the real estate agent’s (or property developers’) trust account.

This amount is usually refundable if you do not proceed due to finance or any other conditions you have put on the contract.

A second, larger deposit amount will be payable later.

4. Home Building Process [Best Practice]

Now it’s time to cover a SUPER misunderstood part of building a home:

The Home Building Process.

This refers to the order in which you should complete everything and why you want to settle your land and build at the same time.

Buying land and then building months later can be a huge mistake. In this chapter, we’ll show you how doing this cost one of our customers $10,000 and the exact steps to avoid making the same mistake.

Why you need to settle your land and build at the same time

Two words: Bank Valuations.

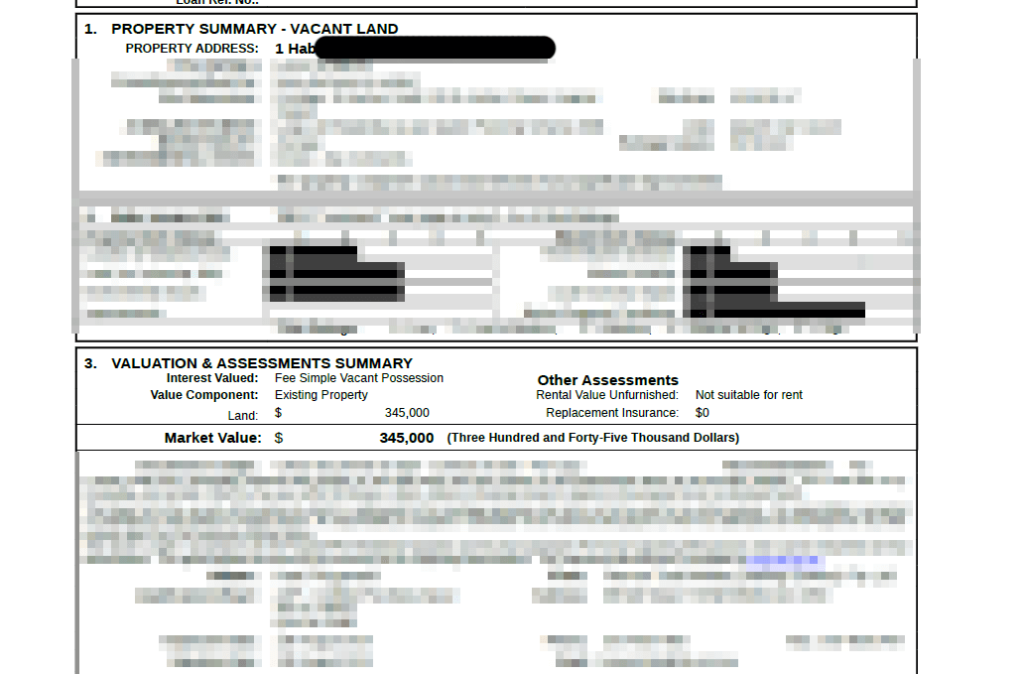

Your bank will complete a valuation on your property based on either:

- The land value if you’re buying a block of land or

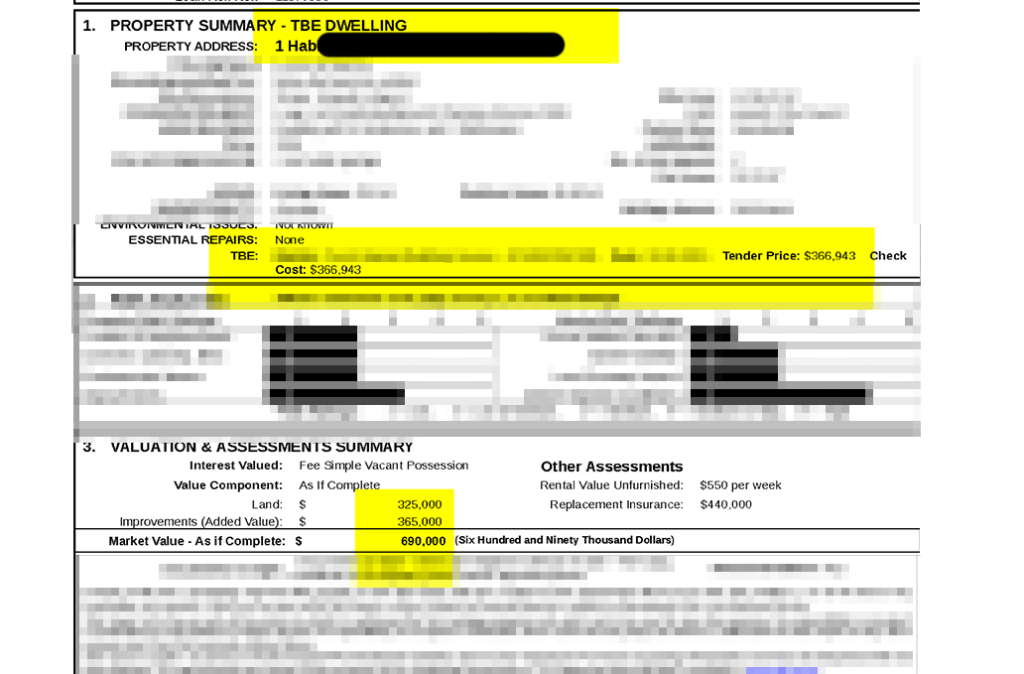

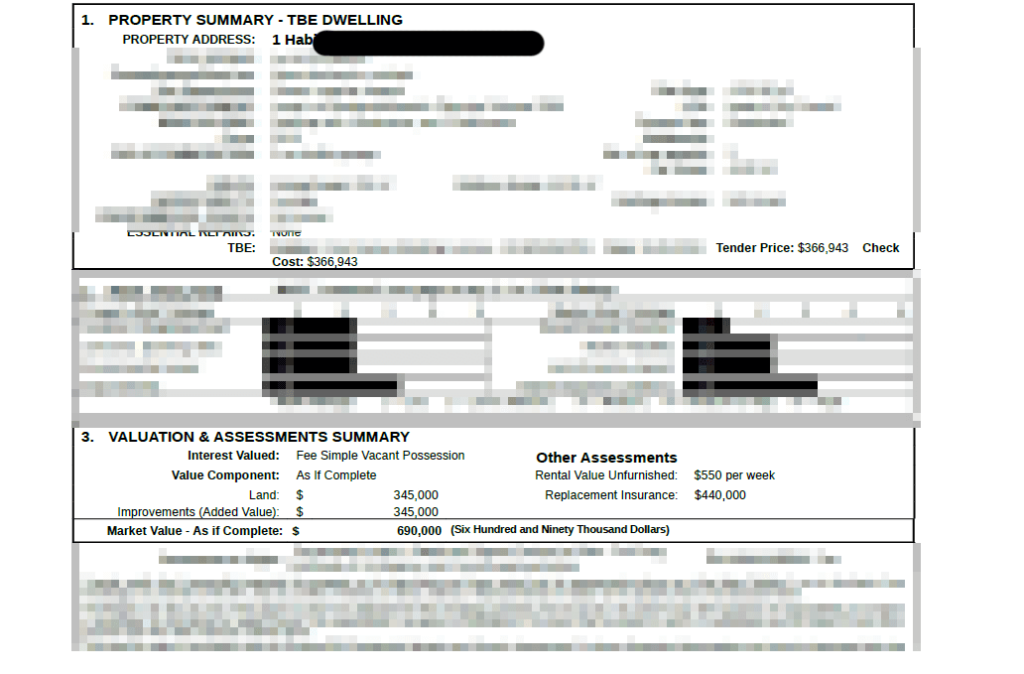

- An ‘as if complete’ value if you are buying land and building at the same time.

Bank valuations are erratic at the best of times. Construction valuations have more risk for the banks – and their valuers.

Right now we are regularly seeing ‘as if complete’ valuations falling short.

This means new home buildings are being valued at lower than it costs to build them by the bank valuers, meaning you’d need a substantially larger deposit…

…or worse, your home loan application could get declined.

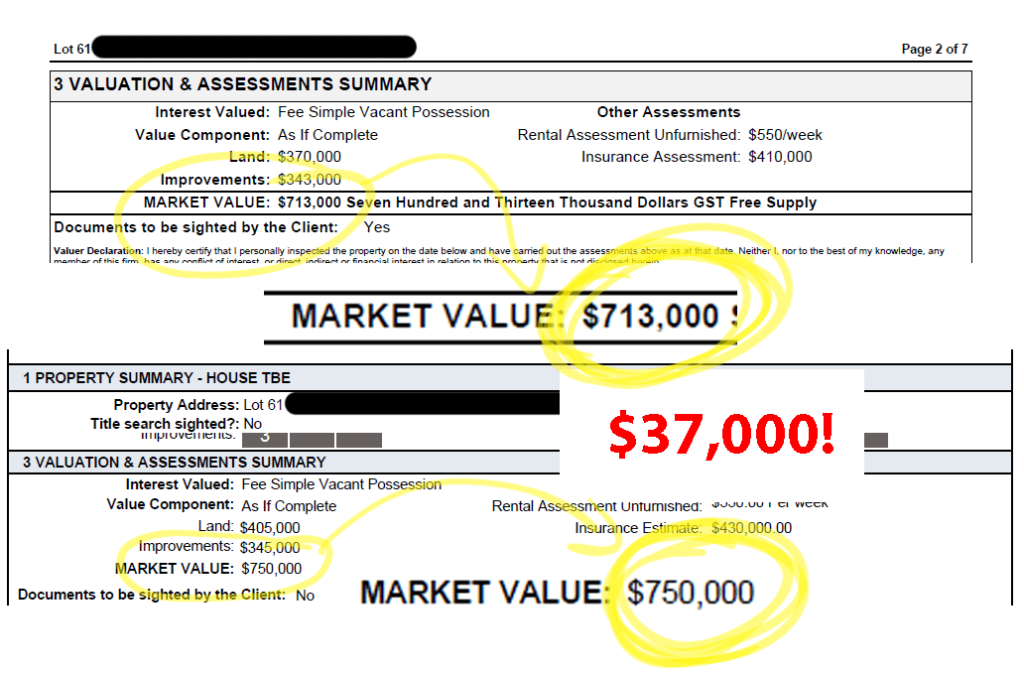

Example 1: $37,000 reason why you want to settle land & build at the same time

So here we have two different valuations. Off the bat, you can see that there’s a $37,000 difference in what the valuers believe the land to be worth. One is saying $405,000, and the other $370,000.

When buying in a new development, the valuer relies on recent sales.

Unfortunately, they’re unable to use the sales in the same development as evidence. Since the valuation is done based on recent sales close by and of a similar size, their valuations fall short because vacant land is very scarce, so they have very little to compare with.

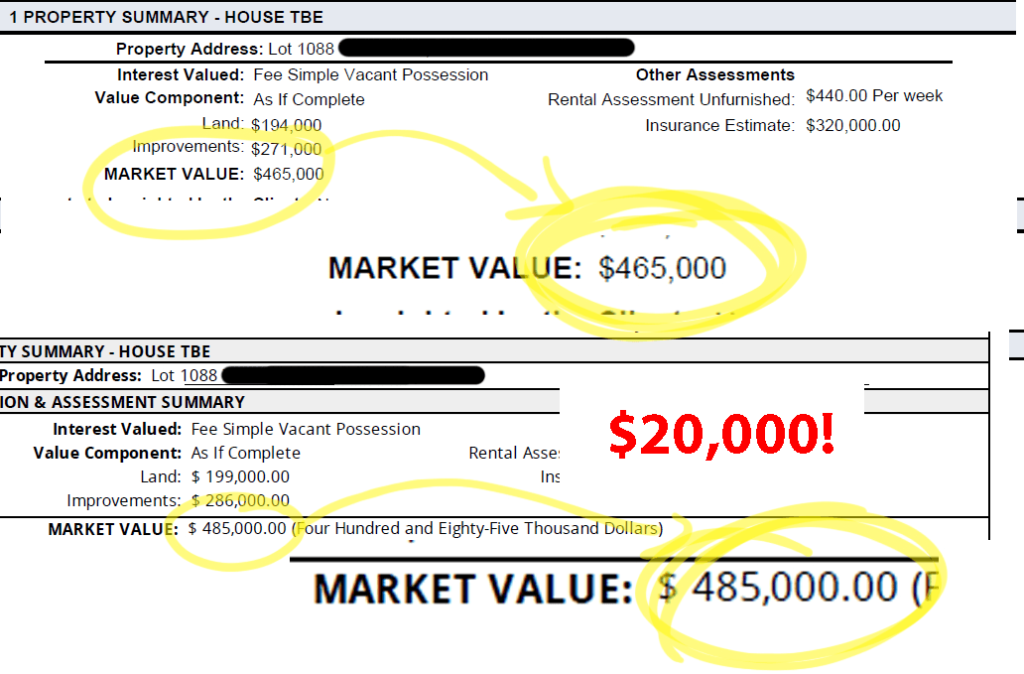

Example 2: The valuer thinks you are spending $20,000 too much

A different problem we see is that the valuers differ in opinion as to what the actual building is worth. One believes the total as-if-complete value to be worth $465,000 and the other $485,000.

So, whilst land value may not be an issue, the building potentially could be.

And when it’s not the land or the building, it can be the landscaping! We’re also seeing valuers reduce valuations when your builder hasn’t included miscellaneous items such as air-conditioning, curtains and fencing!

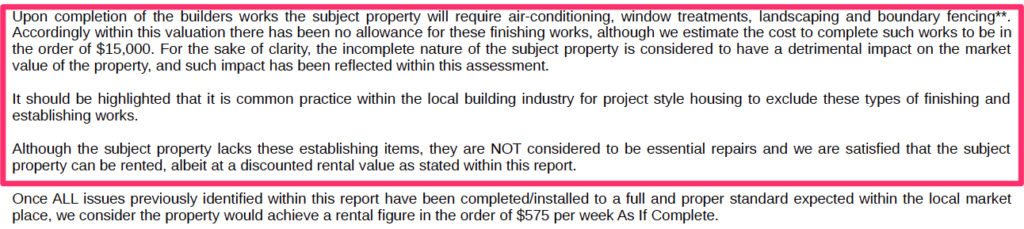

Example 3: The bank believes your property is incomplete, costing you $25,000!

In this specific example, without the listed items, the valuer reduced the valuation by $25,000 as they believed the property was ‘incomplete’.

Half the trouble is that there’s no science in completing a valuation; it’s more of an opinion—a person’s best guess.

But stick around as we’ll uncover what you can do to avoid shortfalls, so keep reading.

Real-life example of why you want to build and buy land all at once

Earlier this year, I met with a couple who were looking for help with finances.

At that time, they were still shopping around builders but had bought a block of land and needed it to settle by the end of July. Helping them with the land everything went to plan and without a hitch.

Fast forward two months, and we were ready to build. The first thing we did was to arrange a bank valuation and were relieved to get the same firm that valued the land.

Previously this firm had valued the land at the purchase price, which gave us a lot of confidence that we wouldn’t experience any difficulties.

But this confidence would be short-lived.

Upon completion, the valuer had undervalued the property by $20,000. But this wasn’t for the build—they had devalued the land.

This was from the very firm that had valued the block of land at the purchase price two months earlier and now reduced this by $20,000. That’s all in the space of two months!!

I immediately challenged the valuer as this seemed like an obvious mistake.

We evidenced the original valuation given two months prior and noted the subsequent reduction of the land by $20,000.

The market and the valuer hadn’t changed, so why the shortfall?

Whilst the valuer admitted fault and updated the land value, they still stood behind their overall valuation of the property. In other words, they just moved the shortfall from the land to the build!

Even though we took this all the way to the top, the bad valuation remained, and our customers had to bear the $20,000 shortfall, which was no fault of their own.

For this customer, a bad valuation meant we needed to switch banks. It ultimately cost them close to $10,000 in both non-refundable mortgage insurance and switching fees.

Let this be a lesson that once a valuation is completed, even if the valuer is unequivocally wrong, the ship has sailed, and to change the valuation is as rare as a hen’s teeth.

Steps to success when building a house in Brisbane.

If you want to be successful when building a home, there are a few steps you must take:

Step to success #1: Focus on the builder

The key to success depends on your builder.

It’s because the only way you’ll know if there’s a shortfall is through a valuation, and for you to get the valuation, you’ll need both the land and build contracts.

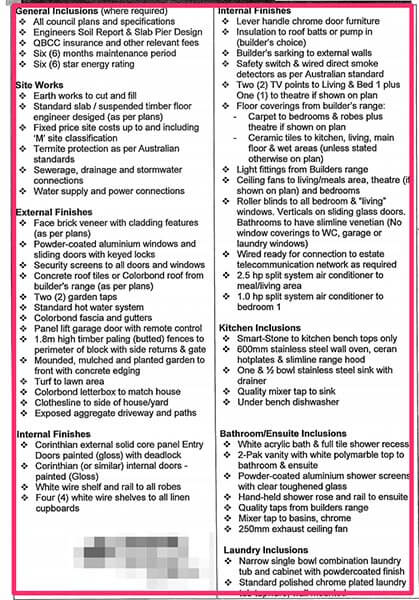

You are going to need the following documents to complete the bank valuation:

- Fixed Price Building Contract (signed by all parties)

- Plans and Specification

- Quotes for everything else you wish to complete. E.g. landscaping, driveway, fencing, window treatment, etc.)

- Copies of all variations

The trouble is that it can take most builders between 6 and 12 weeks to complete your fixed-price building contract, plans and specifications.

As we mentioned earlier, when you’re ready to arrange a valuation, you’ll want to include everything— flooring, fencing, driveway and landscaping.

In short, everything and anything you want to be done to the house must be included.

Providing these items will enable you to lend for them accordingly, so once the build is finished, there’s nothing more to do, and at the same time, you avoid a shortfall.

Step to success #2: Speak with the land developer or seller

This is where you’ll be slowed down, as the sellers just want the block of land sold ASAP. The two big roadblocks at this point will be the finance and settlement dates.

What you want to do is have these linked to your land and build. Just be warned, the seller will want a quick sale – if the land is registered, they will want to get everything settled within 30 days. But this won’t be enough time for you builder, so be prepared to negotiate.

Remember: The sooner your land settles, the sooner you need to make repayments.

Also, consider that most banks are reluctant to offer interest-only repayments on a land loan.

This ultimately means you’ll need to juggle making rent and mortgage repayments while your builder is finalising plans.

On the other hand, if you manage to delay the land settlement and are able to pay the interest only until the completion of the build, it’ll give you heaps of breathing room, so you won’t have to live on baked beans and rice.

Best Practice: Extend your finance and settlement clauses on the land

When you are making an offer on your land or completing an expression of interest, explain to the seller that you need a little more time because you are looking at settling at the same time with your builder.

Speak with your builder to find out how long they expect it will take them to complete the fixed-price contract. When negotiating, we suggest at least asking for:

- Minimum 30 days subject to finance

- Minimum 60 days for settlement

If you’re unable to agree on appropriate finance and settlement terms, you’ll only have two choices:

To either accept the risk associated and start mortgage repayments on the land months before you’re ready to build.

Or be willing to walk away, knowing that buying a property is like waiting at a busy bus stop; if you miss one, nothing’s lost, as there’s always another just around the corner.

Detailed steps in building a house

Time to bring all the steps in building a house together.

Connect with a builder. The first thing you’ll want to do is connect with a builder or builder broker.

Before looking at what land options are available, you’ll want to know the type of property you’re looking to build. Each builder has a unique style and value proposition. At this stage, it’s best to have discussions with a few and hone in on the type of property you’re after. When choosing your builder, the biggest thing you’ll want to know is how long it will take them to generate the documents needed—the fixed-priced build contract, plans and specifications from once you’ve found the land.

Find the land. Now that you’ve shortlisted the builders. The second step is to find land. Knowing how long it will take for the builder to generate the required document and having had a similar conversation with your broker, you’ll now know the appropriate finance and settlement clauses needed for the land contract.

Arrange bank valuations. The third step is to arrange bank valuations. To arrange a bank valuation, your mortgage broker will need the following documents:

- Fixed Price Building Contract (signed by all parties)

- Plans and Specification

- Quotes for everything else you wish to complete. E.g. landscaping, driveway, fencing, window treatment, etc.)

- Copies of all variations

- Copy of your land contract

At this point, your mortgage broker will arrange between three and four valuations with different lenders.

Get your finance approved. The final step is to proceed with a finance application and to get your finance approved. This stage involves compiling your documentation, such as proof of income, bank statements and a list of liabilities. The bank will assess the application and request for more information if necessary. At this stage, it is important to work with an expert mortgage broker to ensure your home loan is approved.

Steps to Building a New Home

So, let’s recap before moving into the costs of building a house;

- Know that there’s a shortfall trend in new build valuations.

- Understand that a shortfall means the difference between getting your home loan approved, declined or needing a much larger deposit.

- The only way around this issue is by doing both the house and land upfront at the same time. The builder needs time to complete their process; speak to them about how long this will take and, if more than 30 days, ask for a longer finance clause.

- When signing the land contract, ask for extended finance and settlement dates. We suggest a minimum of 30 days for finance and 60 days for settlement.

- Get all the documents to your mortgage broker to arrange 2-3 as if complete bank valuations.

5. Costing A House In Brisbane

In this chapter, we’ll reveal some of our favourite “quick and dirty” home costing strategies.

The best part? None of these strategies requires you to speak with a single builder.

Let’s dive right in…

What does it cost to build a home?

The costs of buying a house have increased. In 2011-2012, we were paying an average of $282,000 to build a new house. Today, this figure in Brisbane is closer to $473,000 for a 3-bedroom home.

The costs to build a home depend on 4 major factors:

- If you are building a project home built to a set design by a high-volume builder

- If you are building a custom home which you design yourself from the ground up

- If you are going to use basic finishes

- If you are going to use deluxe finishes

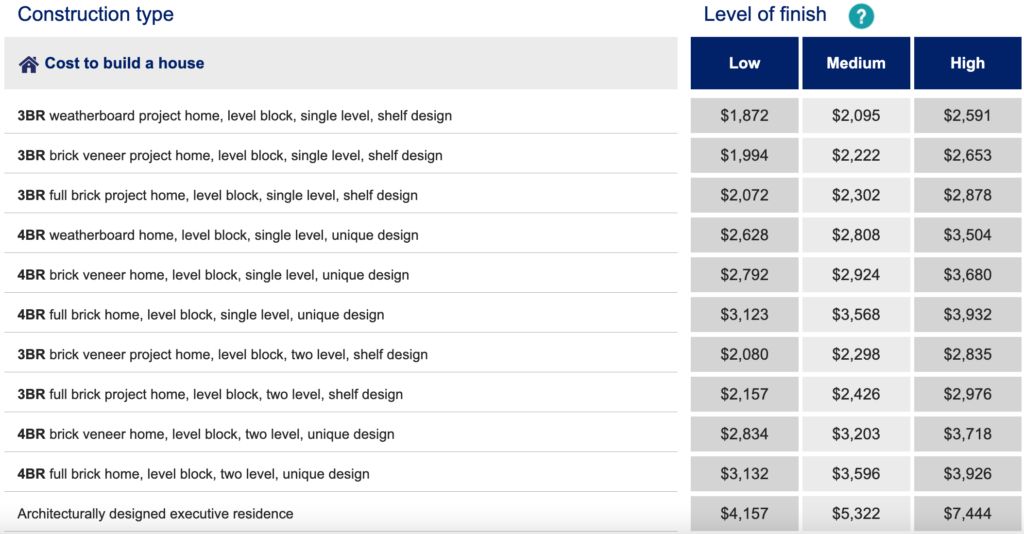

The costs to build a home based on these criteria can range per square metre (a typical 3-bedroom house ranges from 160 to 300 sq/m):

- 3 bedroom Weatherboard Project Home – $1,872 to $2,591

- 3 bedroom Full brick Project Home – $2,072 to $2,878

- 3 bedroom Brick veneer, 2 level Built home – $2,080 to $2,835

- 3 bedroom Deluxe Custom Built Architecturally Designed – $4,157 to $7,444

If you aren’t sure how many square metres your house is going to be, you can use the Home Building Calculator created by WFI.

Follow the steps through, nominate your area, the construction type and how many bedrooms and it will give you an estimated price to build your home in Brisbane.

If you want to get super detailed, you can look at the Architect’s Cost Guide.

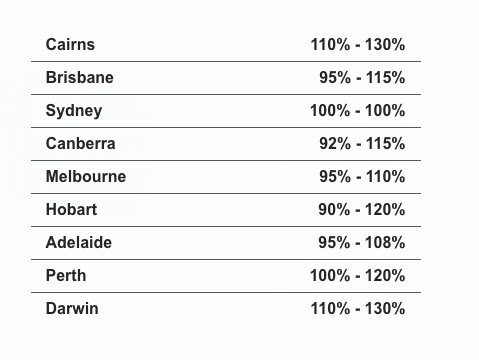

Does it cost more to build a home outside of Brisbane?

Extra costs you need to consider when building a house in Brisbane

Even if you have spoken to a builder, their contract or tender doesn’t include everything. So you need to factor in these extra costs:

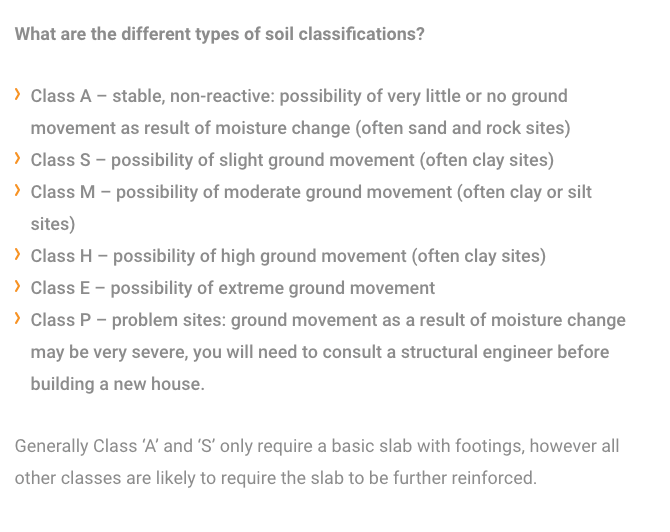

- Quality of Soil – The costings above have been factored on an A Classification Soil which is the best quality you can get. But if your soil has boulders or is clay, then your costs can increase steeply as these are more difficult to build on.

- The slope of the block – As we covered above, a 1m slope in the block can add an extra 20% to the figures quoted above. Other sources indicate an additional $6,000 to $9,000 per metre of slope.

- Soil and Contour Test – This test will check your soil quality and the slope of your block and will cost between $1,500 and $2,000.

- Flood-prone Areas – If you are building in one of Brisbane’s flood-prone suburbs (check if you are here), certain measures need to be taken before you can start building, and the home will be required to be raised, causing additional costs.

- Driveways – Lots of build quotes only include the building, so anything outside, like the driveway, isn’t included and has to be paid for on top of the building contract. A good way to cut expenses here is to gravel the driveway yourself.

- Landscaping, Gardening, & Fencing – Again, the builder’s quote only includes the outside, and many banks will require you to pay for landscaping, gardening and fencing to approve your loan. So, you will need to get a quote and factor in this expense in advance.

- Curtains – Although you would think the builder should include these, they quite often don’t include curtains, blinds and any window fittings. These can add an extra $2,000 to $10,000 depending on the types of blinds or shutters you decide to use.

- Other stuff – Other common costs that are often forgotten are small things like the letterbox, pavers for your outdoor living area, a shed or solar panels. All these small things can add up fast!

What is the cheapest you can build a home in Brisbane?

There are some really affordable options out there if you are looking to build on a budget.

The larger your home is, the more expensive it will be.

Keeping it small will save money.

6. Designing A House

Now that you have an idea of the costs of building a home, you can decide on the best way forward.

Will you be buying a project home or doing a custom build?

While it can be easy to get excited looking at different house designs, kitchens and finishes, it’s important to stick with what your Mortgage Broker has outlined for your budget.

Once you have finished designing your home and have completed your site analysis it’s time to find a builder.

Choosing a Builder

There are two ways of choosing a builder:

- 1. Individually search for builders online and invite individual builders to prepare a quote (also known as a tender) for your house. These days, it is common for builders to request a fee to prepare a quote, but you can negotiate this down or request the fee to be refunded if you proceed with them as the builder.

- 2. Create an open tender that publicly advertises multiple builders to quote on your house. In an increasingly competitive building market, this method is less likely to get lots of high-quality builders. It can also create a disincentive for builders to quote as they know they are up against other builders who are effectively competing on price.

In the eyes of the builder, the first method is preferred as it puts emphasis on the builder, whereas the second open tender process places more emphasis on price.

At the end of the day, your choice of builder is important because, without them, your home will never be built.

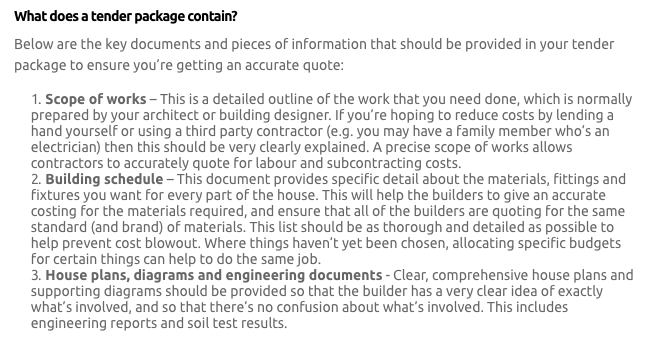

By the end of this process, you want at least 2 to 3 tender packages, which will provide you with a complete scope of work, building schedule and information you will need to compare apples with apples across your builders.

Signing the building contract

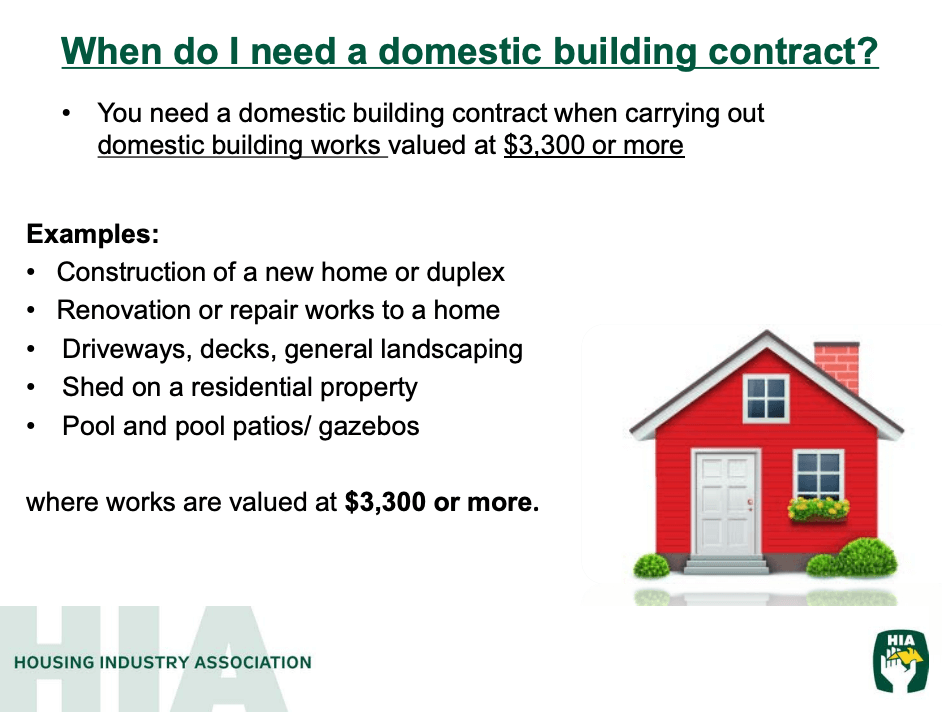

A building contract is a legally binding document between you and the builder. It outlines the terms you have agreed to, the timeframes and the total costs of your house build. As with any legally binding document, it is best to review this with a lawyer before signing it.

Pay the deposit on the build

Once you have signed the contract you will need to pay a deposit to the builder to start construction.

Note: In Queensland, by law, the deposit cannot be more than 20% of the contract price if more than 50% of the work is to be carried out off-site (i.e. kitchen) or 5% for work valued at $20,000 or more.

If your builder asks for a higher deposit, this could be a warning bell, so if unsure, contact the HIA.

At this point, the builder may arrange a follow-up soil and land contour test.

This costs up to $2,000 for a single-story home and up to $3,500 for a double-story home.

Don’t forget to get quotes for the extra work!

As we mentioned above, the builder is responsible for building everything inside the house but generally not much outside.

This is the time to get additional quotes for any extra work you want completed, including:

- Pool & Outdoor Entertaining Area

- Solar Panel + Battery

- Mailbox

- Garden & Landscaping

- Driveway + Paths

- Shed and outdoor storage

7. Get a Construction Loan

In a perfect world, the bank will approve your construction loan quickly and easily.

But we don’t live in a perfect world. However, construction loans can be easy, provided you give the bank the right information upfront.

So, if you are looking to build a home and need a construction loan, follow the steps in this guide.

First, why are construction loans so complicated?

There are lots of people involved in construction loans.

Architects. Real Estate Agents. Solicitors. Builders. Valuers. Banks. Councils…

The list goes on.

A high number of banks and mortgage brokers are not familiar with the construction loan process at all.

As a consequence, there are lots of challenges in financing a house build, including providing the wrong loan amount or delays in paying the builder.

At Hunter Galloway, we specialise in Construction Loans. We have a dedicated construction team who will assist you in arranging payments for the builder.

Read More: How Construction Financing Works

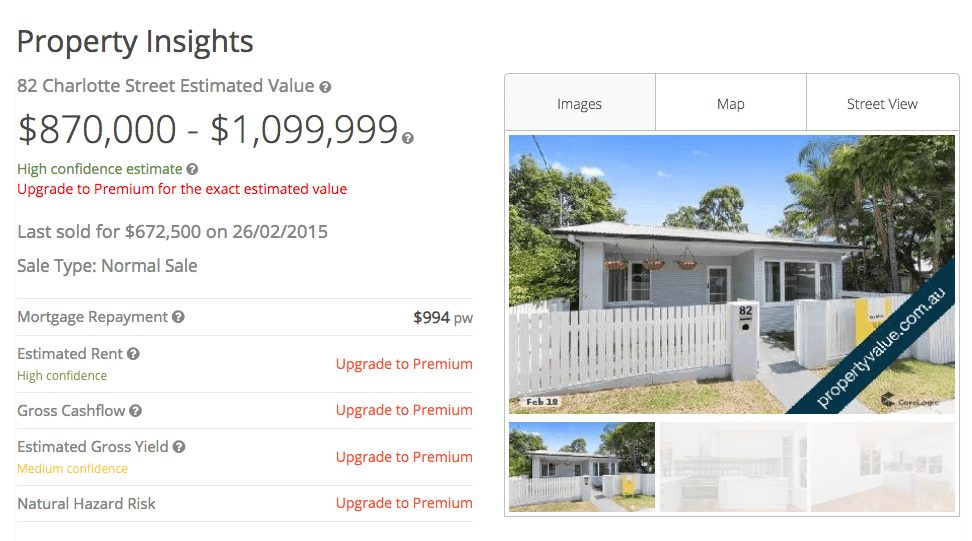

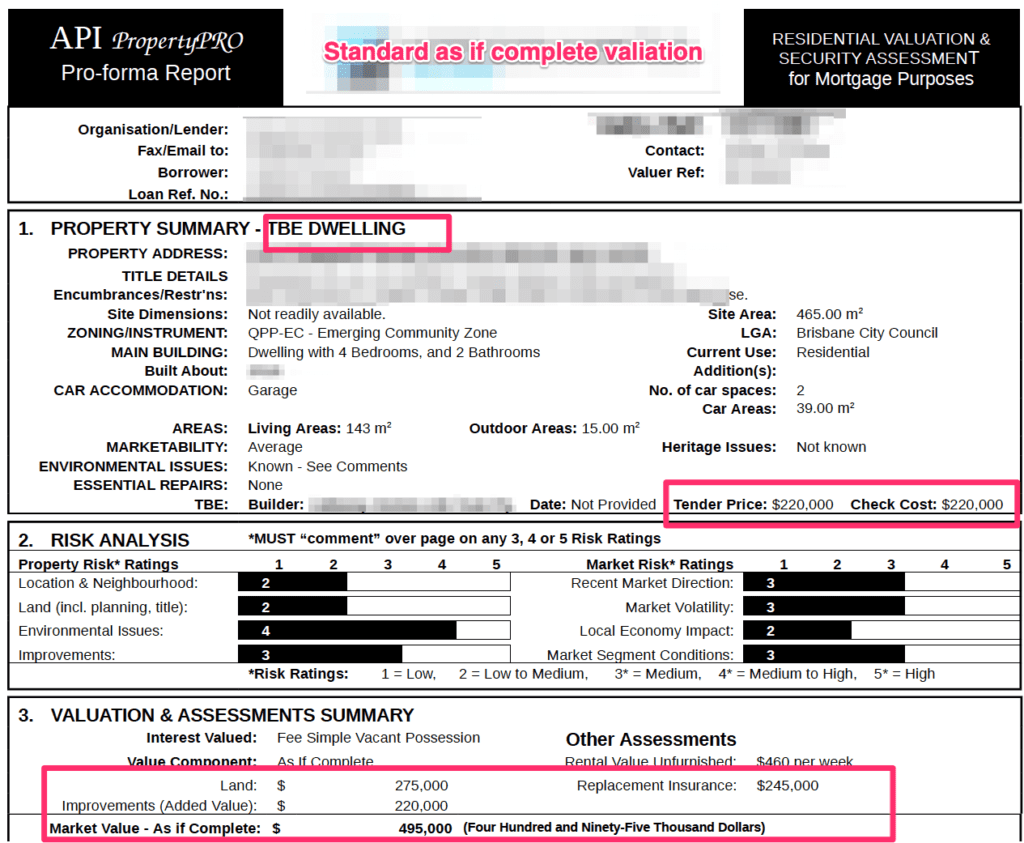

Second, how does the bank value my soon-to-be-built home?

To approve a construction loan, your mortgage broker will arrange an ‘if complete valuation’.

What this means is a valuer will complete a valuation not on what the property is worth today (as vacant land) but on what it will be worth once the construction is completed.

At this stage, your mortgage broker will require some documents to get the valuation completed, including:

- The council approved plans

- Fixed price building contract or detailed quote/tender

- Any extra quotes for additional work (like pool, fencing)

- Builders insurance details

- Building specifications

With this information, your broker can order a bank valuation.

The valuer will consider a few different items to determine what your house is worth. These include:

- The type of home, plan and style: Specifically, the number of bedrooms, number of bathrooms, floor area and any recent property sales in the area that are similar.

- What you originally paid for the land: In some cases, the valuer will just get the price of the land PLUS the price of the construction to determine the house’s value.

- The additional costs you are paying: Items like the pool, landscaping, solar panels, fencing, driveways etc, will factor into the final construction valuation. The bank wants to know that if something goes wrong, they can recover any costs they have lent out.

Read More: How to Challenge a Bank Valuation

How long does it take to get a construction home loan approved?

Putting together a home loan application for a construction loan can take a little bit longer (5-7 business days) than the standard home loan process because you also need the building contract, plans and specifications. You also want to have your bank valuation completed, as the value can vary significantly between different banks. Getting your mortgage broker to arrange a pre-approval beforehand can really speed things up.

How does a construction loan work?

Once your loan is approved, your mortgage broker or bank will arrange payment for the builder during the construction stages.

Typically, there are five progress payments at different stages:

- Slabs poured

- Frame up

- Completion of brickwork

- Lock up

- Practical completion (this is the final payment)

At each stage, you will need to complete a progress payment request, which will authorise the bank to make a payment to the builder on your behalf.

The builder will also give you an invoice, which will include details of the work that has been completed and the amount to be paid.

Are there any common mistakes of construction loans to avoid?

If you had your loan pre-approved, as we detailed earlier, getting your loan unconditionally approved should be fairly easy.

But there are a few common mistakes we see all the time that you want to avoid. Try not to:

- Change or leave your job

- Spend your deposit without keeping receipts

- Miss repayments on your credit cards, personal loans or car loans

- Accidentally overdraw your day-to-day or transactional accounts

These simple errors can completely derail your construction loan, and the bank may not honour their original pre-approval.

Do I make home loan repayments during the construction?

You make interest-only home loan repayments while you have a construction home loan. This is because you will still need to pay the costs of living somewhere else. To help you manage the cash flow, your mortgage broker will arrange interest-only home loan repayments to be made monthly while your house is being built. On a $700,000 home loan, the regular principal and interest repayments at 6% are $4,197 per month (over 30 years) compared to interest-only repayments during a construction period of $3,500 per month.

8. Start Building Your New House

Here’s how this works:

First, you will complete both the land and the loan settlement.

(Don’t worry; you won’t need to attend the settlement; this will be completed by your bank and your solicitor).

Second, the bank will start making progressive payments from your loan to the builder.

Build Stage 1 – Deposit

The deposit stage relates to any pre-work that needs to be completed before starting. The builder might need to order material for your home, like concrete, pipes or bricks.

How much should I pay at the deposit stage?

You should pay a 5% deposit if your build contract is over $20,000.

Build Stage 2 – Base

According to the HIA, the base stage being completed means:

- For a building with concrete floor other than a suspended concrete floor, the stage when the floor of the building is finished

In other words:

The base stage is completed when the concrete slab has been poured and finished.

How much should I pay at the base stage?

You should pay 15% If you are using a standard HIA Progress Payment Schedule.

When you receive the builder’s invoice for the base stage it is important for you to visit the building site, make sure you are happy with the work being completed and then let your mortgage broker know to arrange for the bank to release payment.

If you have qualified for the Homeowners Grant, you should have also submitted your application by this point.

Build Stage 3 – Frame

According to the HIA, the framing stage being completed means:

- The building’s frame is finished, wall frames are fixed, roof frames are fixed and all tie downs and bracing is complete.

Put another way:

The bare walls are up, and you can see the space that will be your home!

How much should I pay at the framing stage?

You should pay 20%, assuming you are using a standard HIA Progress Payment Schedule.

When you receive the builder’s invoice for the framing stage you would have most likely met with the builder on site to check that you are happy with the work completed. If you are happy, let your mortgage broker know to arrange for the bank to release payment.

Build Stage 4 – Enclosed

According to the HIA, the enclosed stage being completed means:

- The house to have all external walls cladded, the roof is fixed, and all external doors and windows are fixed.

So, at this point, you want to be able to lock up your home, and anyone shouldn’t be able to walk straight in.

How much should I pay at the enclosed stage?

You should pay 25%, assuming you are using a standard HIA Progress Payment Schedule.

As with the build stage 3, if you are happy with the work, let your mortgage broker know to release payment to the builder.

Build Stage 5 – Fixing

According to the HIA, the fixing stage being completed means:

- The house to have all internal lining, architraves, cornice, skirting, doors to rooms, shower trays, wet area tiling and built in cupboards fixed in position.

Right now, you want your kitchen in, the walls to look complete (but might not be painted yet), and some flooring in, but things like carpet are not quite in yet.

You are getting close!

How much should I pay at the fixing stage?

You should pay 20%, assuming you are using a standard HIA Progress Payment Schedule.

As with the previous stages, provided you are happy with the work completed by the builder, you can let your mortgage broker know they can release the payment to the builder.

Build Stage 6 – Practical Completion (Finishing)

According to the HIA, the practical completion stage looks like:

- The day all the work is completed, in compliance with the contract, including all plans and specifications for the work and without any defects or omissions by the builder.

At this stage, your home should be complete! You should have been through the house with your builder and noted any defects or issues which they should have fixed.

How much should I pay at the practical completion stage?

You should pay the last 15%, assuming you are using a standard HIA Progress Payment Schedule.

This stage is a little bit different from the others as your home will require a few final inspections:

- 1. Final Inspection Certificate: The building certifier will visit the property to confirm it has been built in accordance with the government and local council requirements. The final inspection certificate, also known as the occupancy certificate, means you can live in the home!

- 2. Final Valuation Inspection: The bank will arrange for a valuer to complete one final visit to confirm the property has been completed as outlined in the construction contract and nothing has been missed.

- 3. The owner’s handover: As the owner, you will be given a detailed tour of the home with the builder. They’ll explain how everything works and give you the opportunity to identify any defects (like scratches in the wall or areas they might not have painted that well). If there is something wrong, you will give the builder time to fix anything they may have accidentally missed. The builder has 10 days to fix these up.

When you are completely happy with the house, you can instruct your mortgage broker to arrange the final practical completion payment.

9. Move Into Your New Home

You’ve finally made it, moving day!

Before you move, remember to do the following:

- Get utilities connected

- Redirect your mail

Bonus: How to Build a House Checklist

Building a home can be a stressful process, so make sure you don’t miss anything, from checking your builder to making sure nothing is missed on the plans.

Download our Build a House Checklist to make sure everything goes smoothly when you build a house in Brisbane.

Are You Ready To Build Your House?

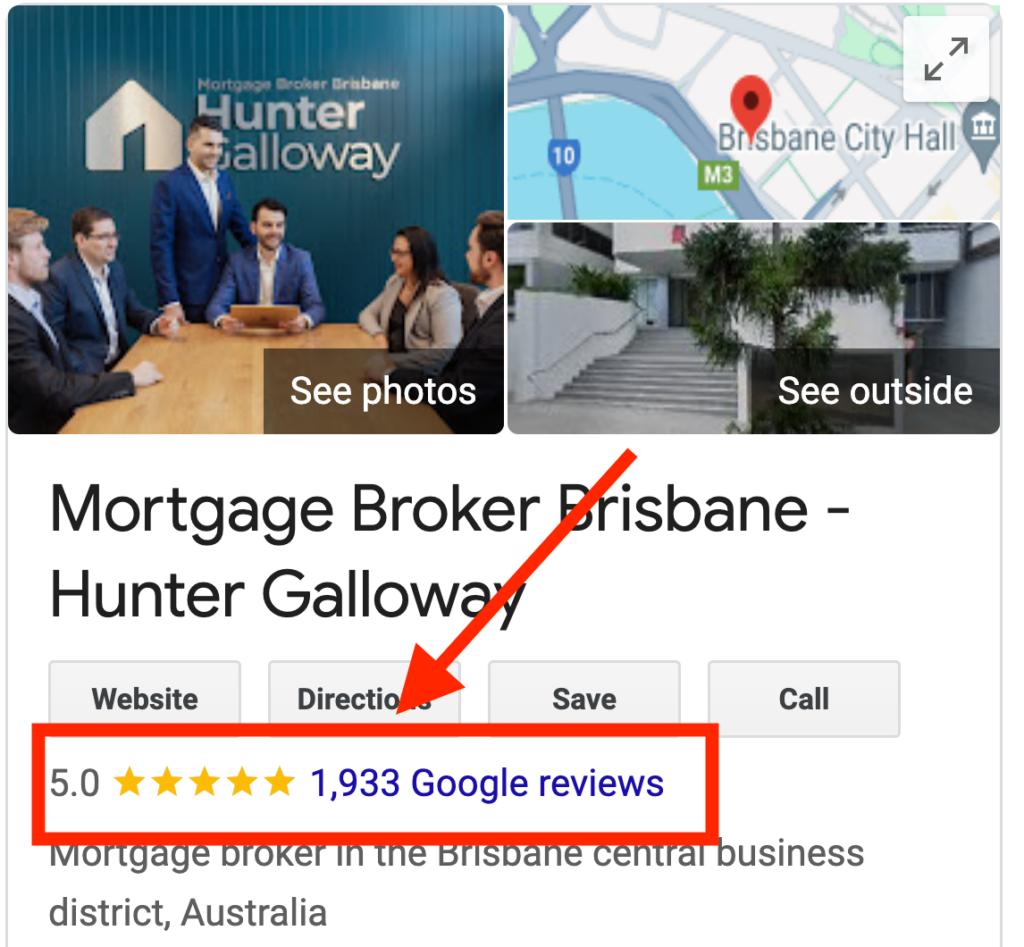

Ready to take the next step toward buying? We’re happy to help. Schedule a call today with a Home Loan Expert from Hunter Galloway, the home of home buyers.

If you would like to chat about building a new home and getting a home loan, we’d be delighted to help you out. Speak with one of our experienced mortgage brokers to walk through the next steps with you.

Unlike other mortgage brokers who are just one-person operations, we have an entire team of experts dedicated to helping make your home loan journey as simple as possible.

If you want to get started, please give us a call on 1300 088 065 or book a free assessment online to see how we can help.

Start again

Start again