Table of Contents

Thinking of buying your first home in Queensland in 2025? You could be eligible for a massive $30,000 First Home Owners Grant—one of the most generous in Australia. In this guide, written by an award-winning mortgage broker in Brisbane, we’ll walk you through everything you need to know about the grant. We will share how the grant impacts your borrowing power, what to do if your application is rejected, and how QLD compares to other states.

What Is The First Home Owners Grant?

The Queensland First Home Owners Grant is a financial assistance program designed to help eligible first-time home buyers in Queensland. It is a one-off grant given to Australians who want to buy a home for the first time.

How Much Is the First Home Owners' Grant in QLD?

How much you will get under the grant depends on when you signed your contract. For contracts signed after 20 November 2023, the grant is $30,000. This enhanced grant is applicable for new builds under $750,000.

However, if you signed a contract before then, i.e. before 20 November 2023, the grant is $15,000. More details here.

First Home Buyers Grant QLD Rules And Eligibility

To be eligible for the QLD First Home Owners’ Grant, you must pass the eligibility criteria for your personal circumstances and the property.

Personal requirements

The following eligibility criteria apply for the First Home Owners’ Grant:

Age: You must be aged 18 years or older. If you are applying with a co-applicant, they must also be 18 or older.

Citizenship: You need to be either an Australian citizen or a permanent resident. If you are applying with a co-applicant, only one applicant needs to be a citizen or permanent resident.

Previous grant recipients are not eligible: Neither you nor your spouse should have previously received a First Home Owner Grant in any Australian state or territory.

Previous homeowners are not eligible: You or your spouse must not have owned residential property in Australia that you lived in on or after 1 July 2000.

Investment properties are okay. If you have owned an investment property after July 2000 and never lived in it, you will be eligible for the grant provided you intend to live in the new home. However, you will need to provide documents such as tenancy or lease agreements to prove that you never lived in the investment property.

Residence requirements: You must move into the new home as your principal place of residence within 1 year of the completed transaction and live there continuously for 6 months. You are allowed to rent out one room in your house during this period, but if you do this, you may lose out on other grants, such as stamp duty discounts.

Income: There are no income caps on the first home owners grant

Property requirements

Not all properties are eligible for the grant. Only new or substantially renovated properties are eligible.

Property type: The property can be one of the following:

- a house, unit, duplex or townhouse

- a granny flat built on a relative’s land

- a home that has been moved from one site to another

- a substantially renovated home

Transaction type: The property transaction type can be one of the following:

- new home

- off-the-plan purchase

- substantial renovation

- contract to build

- owner-builder

Value of the property: The total value of the home must be less than $750,000, including the cost of the land and any changes made to the contract.

For a full list of criteria for eligibility, check out the list here.

What can cause me to be disqualified from the scheme?

According to the QLD government website, you may be disqualified from the scheme if you meet the eligibility criteria above but:

you buy or build your new home with financial help from a related person (who is not eligible for the grant) who will also stay in the home often or for long periods of time, and the Commissioner is not satisfied there are genuine family reasons for the related person to occupy the home. (Money borrowed from a bank or lending institution is not considered to be financial help.) If there is a disqualifying arrangement, we will not pay the grant. If the grant has already been paid, you will have to repay it.

How To Apply For The First Home Owners Grant?

- If you are buying a home, you must apply within 1 year of you moving into the property and of the new home and your title being registered.

- If you have a build contract, you must apply within 1 year of the house being completed and the final inspection certificate being issued.

- If you are building the home by yourself, you must apply within 1 year of the house being completed and the final inspection certificate being issued.

You will also need to provide supporting documents, which we will cover below.

Using The First Home Owners' Grant As A Deposit

One of the great things about the First Home Owners’ Grant is that you can use it as part of your deposit.

This amounts to 4% of a $750,000 home, so it can jumpstart your home-buying process and get you on the property ladder much sooner than you think.

However, you will still need to contribute some of your own money towards buying a home. This is because many banks will need to see evidence of genuine savings if you’re purchasing with a minimal deposit, and the First Home Owners’ Grant doesn’t count as genuine savings.

You’ll also need to take into account other buying costs, which can add up to around 3% of the purchase price of your property.

To find out exactly how much deposit you will need to buy a property, get a free assessment with one of our mortgage brokers. We can calculate these figures for you based on your unique circumstances.

Read more: How much deposit do I need to buy a home?

How The $30,000 FHOG Impacts Your Borrowing Power

The First Home Owners Grant is more than just a bonus — it can seriously change your borrowing power.

The Grant Doesn't Count as Genuine Savings

Most lenders want to see “genuine savings.” This means money you’ve saved consistently over three to six months. Unfortunately, the $30,000 FHOG doesn’t usually count. That’s because it’s a one-off payment from the government — not your own savings. So, while helpful, it can’t replace your personal contribution.

It Can Still Help Reduce Your Loan Costs

Even though it’s not genuine savings, the grant still boosts your deposit. This helps lower your Loan-to-Value Ratio (LVR) — which can save you thousands. A lower LVR could reduce or remove Lenders Mortgage Insurance (LMI). For example, on a $650,000 home, the grant could shave off up to $12,000 in LMI fees.

Can It Help With Loan Approval?

Yes — but only if you still meet the lender’s deposit and income requirements. Banks will look at the full picture: your savings, debts, income, and expenses. We help you present everything clearly to get your best shot at approval.

Real Case Study: How the $30,000 FHOG Helped Olivia Buy Her First Home

Let’s look at how the First Home Owners Grant made a real difference for one of our clients.

Meet Olivia — First Home Buyer in Brisbane

Olivia is a 28-year-old nurse earning $90,000 a year.

She had saved $35,000 over 18 months and was looking to buy a townhouse in Brisbane.

She found a brand-new townhouse priced at $720,000.

Because the home was new and under the $750,000 cap, she qualified for the $30,000 FHOG.

How the Numbers Worked

Here’s how Olivia’s finances looked with and without the grant:

Item | Without FHOG | With FHOG |

Purchase Price | $720,000 | $720,000 |

Deposit | $35,000 | $35,000 + $30,000 (FHOG) = $65,000 |

Loan Required | $685,000 | $655,000 |

LVR | 95% | 91% |

LMI Cost | $18,000 | $9,000 |

Total Savings | – | $9,000 saved on LMI |

With the grant added to her deposit, her Loan-to-Value Ratio dropped, and she paid half as much LMI.

What It Meant for Olivia

Thanks to the grant:

- She didn’t need to delay her purchase

- Her loan was easier to approve

- She saved thousands in upfront costs

- She kept more of her own savings for furniture and moving costs

We Helped Her Apply

Our team handled her FHOG application and home loan all at once. She got approved within 3 weeks and moved into her new home a month later.

How To Apply For The QLD First Home Buyer Grant

If you work with Hunter Galloway, we’ll help you complete the First Home Owners Grant application form as a part of your home loan application.

We will help you fill out and complete the paperwork to make it super easy!

There’s also an online lodgement form that you can find here.

The total First Home Buyers Application Form is 15 pages long and has 8 main sections:

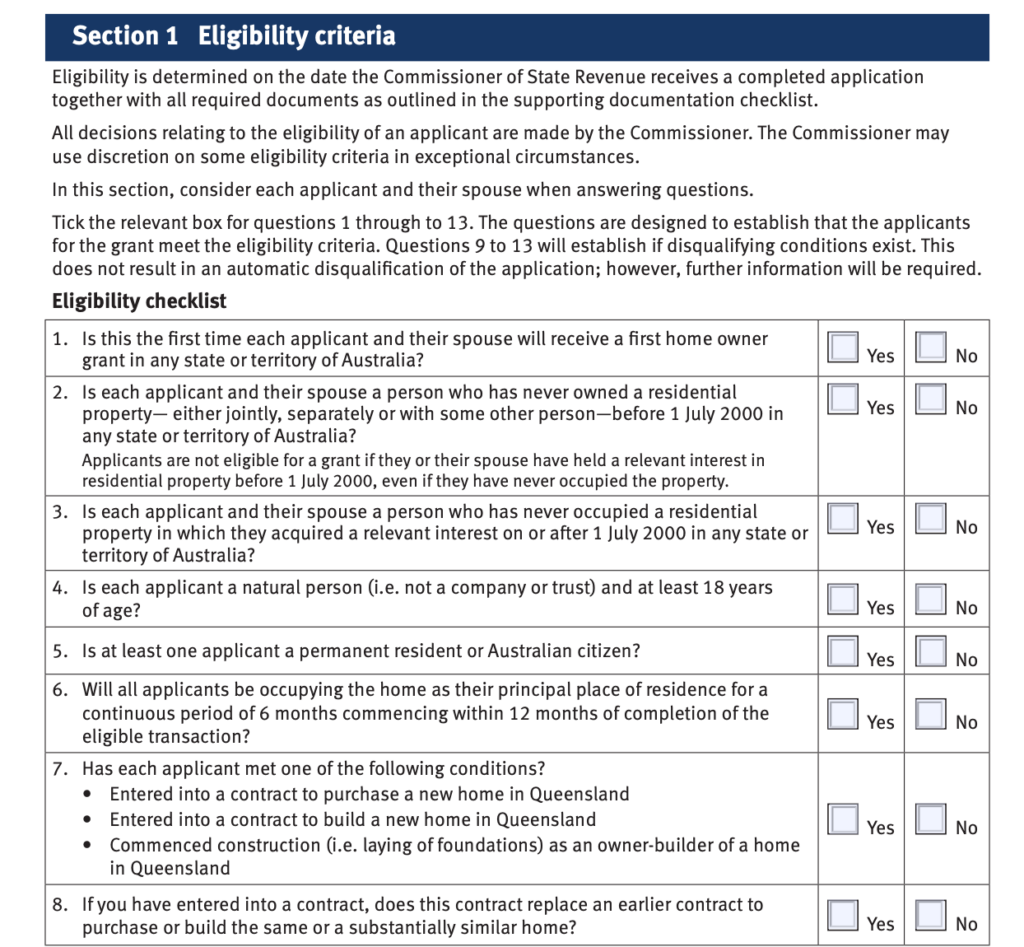

Section 1: Eligibility Criteria

The first section of the First Home Buyers Application form for the Queensland First Home Owners Grant checks that you are able to apply for the grant. A qualifying first homeowner will answer ‘yes’ to questions 1 to 8, then ‘no’ for questions from 9 onwards.

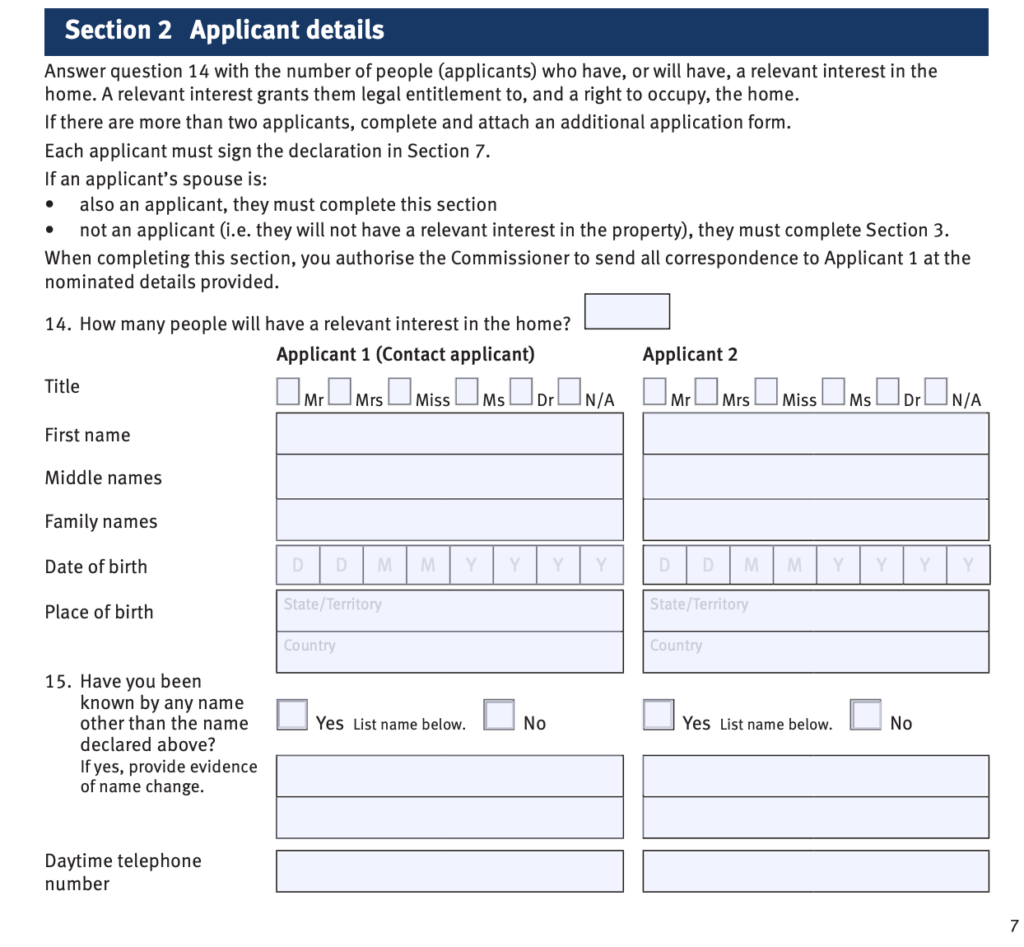

Section 2: Applicant Details

This section of the application form has all your basic personal information, name, address, contact details, and all the simple stuff for you and your partner.

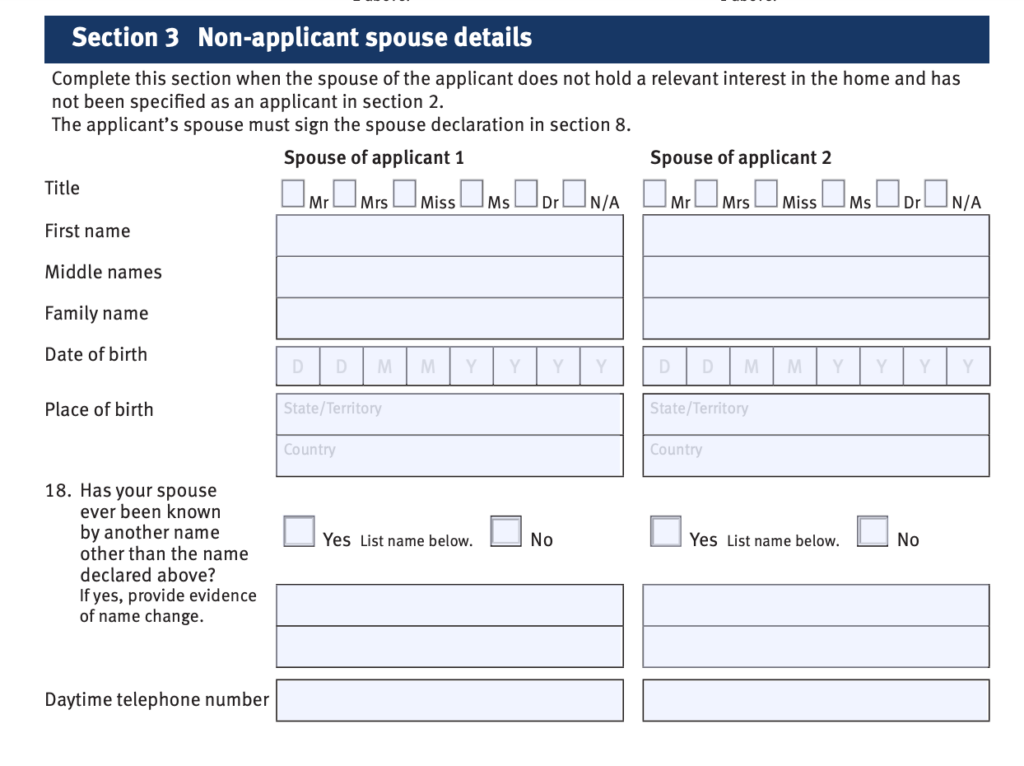

Section 3: Spouse Details

Section 3 is only there if you have a partner or spouse who is not an applicant that you detailed in section 2. If you do not have a partner or spouse, you can skip this section and continue to section 4!

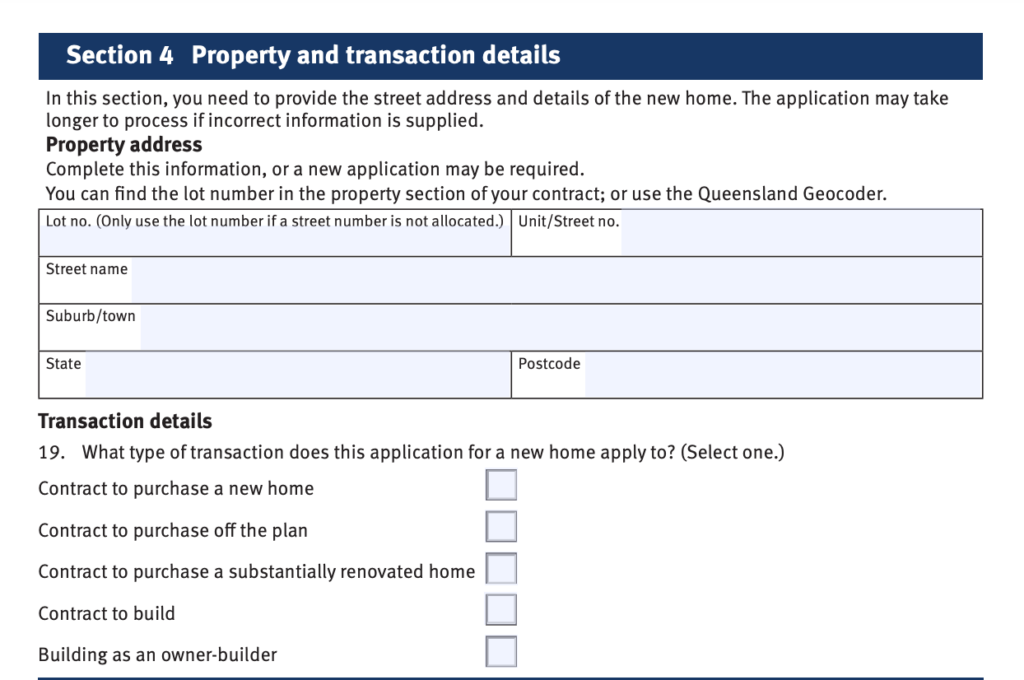

Section 4: Property and Transaction Details

In section 4, you will need to include the details of the property you are purchasing or building as well as the type of property.

The options in section 4 include the following: only choose 1 option.

- Contract to purchase a new home

- Contract to purchase a substantially renovated home

- Contract to build

- Contract to purchase off-the-plan

- A building as an owner-builder

Buying off the plan means purchasing a property before the building is out of the construction phase and the title has yet to be created.

If you are buying off the plan, it means the property is not completed yet, so if you have bought a new property that is ready to be moved into, you can choose ‘contract to purchase a new home’.

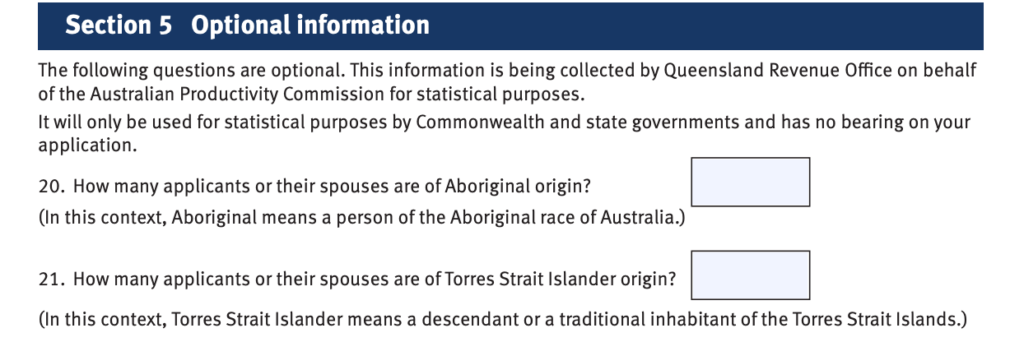

Section 5: Optional Information

As the name suggests, this is not a mandatory section and only applies if you are Aboriginal or a descendant of the Torres Strait.

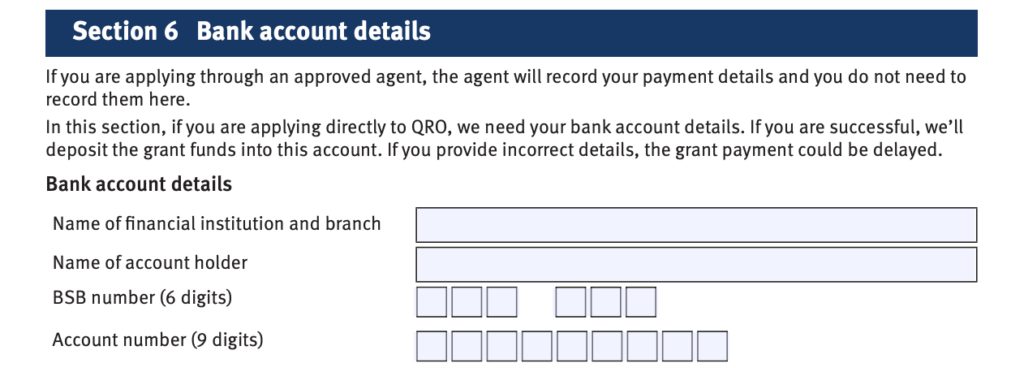

Section 6: Bank Account Details

Since the grant is paid into your account, this is the part where you enter your banking details.

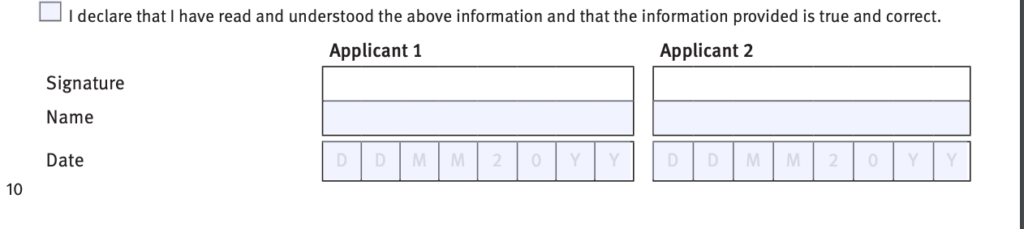

Section 7: Declaration by Applicant

There are 24 declarations in this part. After reading them, you and your spouse (if you are applying together) must then sign the application form,

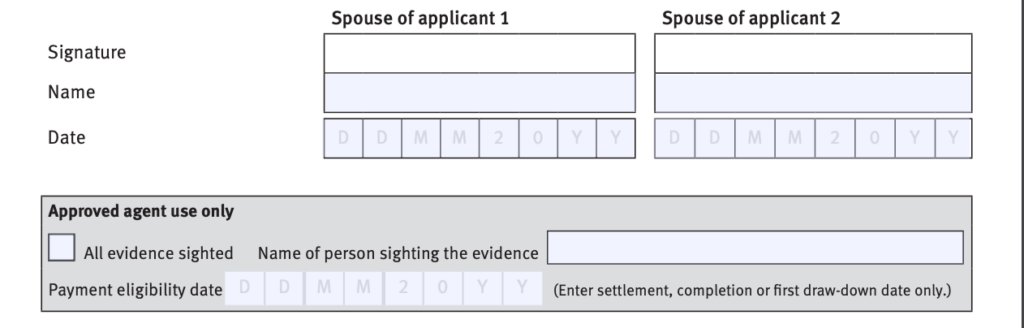

Section 8: Declaration by Spouse

When your partner is not part of the application, they sign this section.

What Supporting Documents Do I Need To Apply For The First Home Owners Grant in QLD?

When applying for the First Home Owner Grant in Queensland, you must provide various supporting documents with your application form. Here’s a summary of the required documents:

Proof of Identity:

Provide one document from each of the following categories:

- Category 1: Australian birth certificate, current Australian passport, Australian citizenship certificate, current passport or ImmiCard with visa, or Titre de Voyage.

- Category 2: Current Australian driver’s licence, firearm licence, proof of age card, or passport.

- Category 3: Valid Medicare card, car registration, debit/credit card, concession card, or Veteran card.

- Category 4: Recent utility bill, bank statement, or home insurance policy showing your name and address.

If you’ve changed your name or marital status, provide relevant certificates or documents.

For non-applicant spouses residing overseas, a current identification document from their country of residence is required.

Financial Help:

If you’ve received financial help, provide a statutory declaration describing the help received or a copy of the financial arrangement if it’s in writing.

If the financial help is from a related person who will live in or frequently use the home, details must be provided in the statutory declaration.

For Different Types of Homes:

- New Home (including off the plan): Signed contract, registration confirmation statement or title search, and final inspection certificate. A vendor statement is needed if the home is not off the plan.

- Substantially Renovated Homes: Same as for a new home, plus a tax invoice showing GST, a statement from the seller about the renovations and a final inspection certificate

- Contract to Build: Signed contract, registration confirmation statement or title search, final inspection certificate, and valuation or market appraisal of the land.

- Owner–Builder: Registration confirmation statement or title search, first inspection certificate, owner–builder cost summary, receipts, independent valuation or market appraisal, and final inspection certificate.

- Building on a Relative’s Land: Statement or written agreement from the relative authorising the build.

- Purchase from Related Person or No Contract: Stamped Titles Queensland Form 1 Transfer, evidence of payment, statement from the vendor, and independent valuation or market appraisal.

- Manufactured or Mobile Homes: Site agreement, lease, or other relevant agreement for land occupancy.

What Happens If Your Queensland First Home Buyers Grant Application Is Rejected?

It’s rare, but FHOG applications can get declined.

The good news? In most cases, you can fix the issue.

First, Find Out Why

Common reasons include:

- Missing documents

- Incorrect details

- Ineligibility (for example, you’ve owned property before)

Once you know the reason, you can fix it and reapply.

What You Can Do Next

If your grant was denied due to paperwork, resubmit with the correct documents.

Still not sure what went wrong?

Contact the Queensland Revenue Office (QRO) or speak with your broker.

You can also lodge an appeal or request a review if you believe the decision was unfair.

We’ve helped clients do this successfully.

Our Team Can Help

We’ll go through your situation, check every detail, and help you reapply. If needed, we’ll talk directly to QRO on your behalf.

QLD vs Other States: How Does the Grant Compare?

Queensland’s FHOG is now one of the most generous in Australia.

Here’s how it stacks up against other states.

FHOG Comparison Table (As of August 2025)

State | Grant Amount | Property Cap | Key Conditions |

QLD | $30,000 | $750,000 | New builds only |

NSW | $10,000 | $750,000 | New homes only |

VIC | $10,000 | $750,000 | Regional VIC: extra $10k ended July 2021 |

WA | $10,000 | $750,000 – $1M | Regional cap is higher |

SA | $15,000 | $650,000 | New homes or building contracts |

TAS | $30,000 | None | New builds only |

NT | $10,000 | None | New homes only |

ACT | None | N/A | Grant replaced with stamp duty concessions |

Why QLD’s Grant Stands Out

- It’s double most other states’ grants

- Property cap is competitive at $750,000

- No income cap applies

- It can be combined with other schemes

What Other Incentives Am I Eligible For In QLD?

Besides the First Home Owners’ Grant, there are some other schemes and concessions that can help you buy your first home. Here’s a quick overview:

Stamp Duty Concessions

Properties Valued at $700,000 or Less: If you’re purchasing your first home valued at $700,000 or less, you may be eligible for a full exemption from transfer (stamp) duty. This exemption can save you up to $24,525.

Properties Valued Between $700,001 and $799,999.99: For homes valued between $700,001 and $799,999.99, a partial concession applies, reducing the amount of transfer duty payable. The concession decreases as the property value increases within this range.

Properties Valued at $800,000 or More: For properties valued at $800,000 or more, the First Home Concession does not apply. However, you may still be eligible for the general Home Concession, which offers a reduced rate of duty but not a full exemption.

Home Guarantee Scheme

There are three separate schemes under the Home Guarantee Scheme, which you can use in combination with your First Home Owner’s Grant. Here’s a quick overview:

First Home Guarantee

This scheme is open to all first-home buyers (if you meet the eligibility criteria) and lets you buy a home with just a 5% deposit without paying lenders mortgage insurance.

Regional First Home Buyer Guarantee

This one’s especially for people buying homes in regional areas. Like the First Home Guarantee, you only need a 5% deposit.

Family Home Guarantee

This one’s for single parents or guardians. You can buy a home with a super low deposit of just 2%.

Read more: First home guarantee.

First Home Super Saver

This scheme helps you save for your home deposit in your superannuation (like a retirement fund). It has some tax benefits, and you can save up to $50,000 for your deposit.

Read more: First Home Super Saver Scheme.

Help to Buy Scheme

This scheme is about sharing the cost of buying a home. The government can pay up to 40% of the price for a new home or 30% for an existing one. This is to make homes more affordable, and there are 10,000 spots each year for people who qualify.

Read more: Help to Buy Scheme.

Frequently Asked Questions

What is the First Home Owner Grant?

The First Home Owners’ Grant is a financial aid program for first-home buyers who are buying or building a new home. This grant comes as a one-off payment of $30,000.

Who is eligible for this grant?

First-time homebuyers who are Australian citizens or permanent residents planning to live in the new home as their primary residence.

How much is the grant?

The grant is currently $30,000 and will remain at this amount until 2025.

Is the grant still available in QLD?

Yes, the First Home Owners’ Grant is still available in Queensland and will remain available at its current value.

Can I use the FHOG for a home deposit?

Yes, you can use the grant money as a deposit. However, some banks may not accept it as evidence of genuine savings so that you may need additional funds.

Are there restrictions on the type of home I can buy?

The grant applies to new homes, including houses, townhouses, apartments, and substantially renovated properties. The maximum property value is $750,000. Established homes (ones that have been lived in before) are not eligible for the grant.

What documents are needed to apply?

You will need proof of identity, details of the property transaction, and possibly some financial information. We recommend speaking with a broker to find out what documents you need before applying for the grant.

How and when to apply for the first home buyer grant?

We recommend applying for the grant when arranging your home loan or before settlement. You can apply through your lender or directly with the government, but we recommend applying through a broker. We can fill out the form for you and ensure everything is correct before applying.

Is there an income test for the grant?

No, there is no income test for the grant. However, you will still need to meet the bank’s lending standards.

Is there a spending limit for the grant?

Yes, the total value of the property must be under $750,000. This includes land and additional costs like driveways and landscaping.

What happens if I move out before 6 months in the first year?

If you need to move out of your home within the first six months of your first year, you may have to repay the grant. It’s best to contact the Queensland Revenue Office if this occurs.

Do both partners get the grant if buying together as first home buyers?

No. There is only one payment made per application.

Can I receive the grant if I've owned an investment property?

If you have owned an investment property that has always been used as an investment, you may still be eligible.

Can I use the grant to buy land?

No. The grant is only to be used for building costs. You will need savings for the land if you buy it separately.

Can I get the grant if I'm on a temporary visa?

Temporary visa holders are ineligible for the grant. If you are applying with a partner and they are either a citizen or permanent resident, you will be eligible.

Is the grant available for existing homes?

Generally no. The exception is when there have been substantial renovations to the home. A new coat of paint or a single renovated room wouldn’t qualify; the entire home has to be renovated.

When is the grant paid?

The exact time of payment varies. It is paid upon sale completion for new builds from developers or when construction begins for self-built properties.

What happens if my First Home Owners Grant Qld application is rejected?

If your application is rejected, you can usually resubmit it with the correct documents. In some cases, you may appeal the decision through the Queensland Revenue Office. Your mortgage broker can also assist you in understanding and fixing the issues.

Can I still get the grant if someone helps me pay for the home?

It depends on who helps you and their living arrangements. If a related person provides financial help and plans to live in the home, you might be disqualified unless you prove there’s a genuine family reason. Money borrowed from banks does not affect your eligibility.

Is the first home buyers grant QLD $50,000?

No, the First Home Buyers Grant in Queensland is currently $30,000 for eligible contracts signed between 20 November 2023 and 30 June 2025. There is no $50,000 grant available under the current scheme. Be cautious of outdated or misleading information online

Next Steps To Getting Your Home Loan

Our team here at Hunter Galloway is here to help you buy a home in Brisbane.

Unlike other mortgage brokers who are just one-person operations, we have an entire team of experts to help make your home loan journey as simple as possible.

If you want to get started, give us a call on 1300 088 065 or book a free assessment online to see how we can help.

Start again

Start again