First Home Buyer Hub Get the right home loan Why you should get a pre approval

Why you should get a pre approval

Securing a formal home loan pre-approval is the best way to bargain for a good price with the seller. Some real estate agents and vendors won’t actually accept your offer if you don’t have a signed pre-approval offer, so here are our tips for pre-approval.

- ✅ Sign an application form of a mortgage broker.

- ✅ Provide proof of loans, credit cards, savings, and income.

- ✅ When a mortgage broker completes the preliminary assessment, a number of loan products and lenders will be recommended by them.

- ✅ Once you select a lender, the loan application is submitted to the broker, along with all the documents.

- ✅ The lender evaluates your application and provides a home loan pre-approval.

What Do I Need to Get a Home Loan?

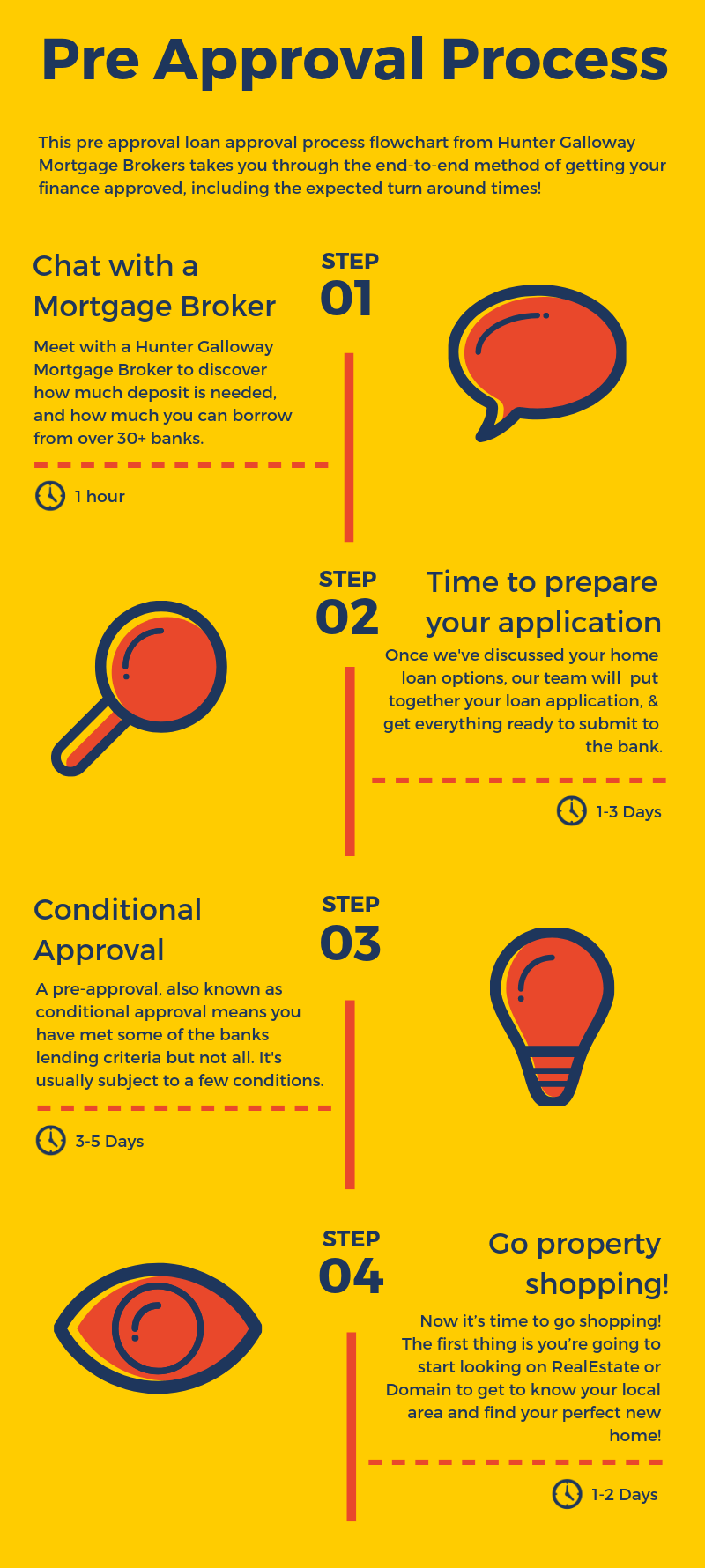

The first step in the home loan application process is the eligibility assessment. The mortgage broker will set up a meeting and assess your current financial situation to find out if you meet the eligibility criteria. They will also discuss your objectives and requirements to find out the best solution for you.

You are required to provide the following list of documents during the application process:

- ✅ Identity documents, passport and driver’s license

- ✅ Payslips, group certificates

- ✅ Bank account statement

- ✅ Expenses and liabilities account

- ✅ Documents containing asset details, and

- ✅ Contract of sale

The bank will ask to check your pay account and look for salary credits and loan repayments.

Not all pre-approvals are created equal.

In most cases a pre-approval is just an indication that the bank is okay to consider approving your loan; the bank may just complete a credit check and not check any of your documents and wait until you lodge a full mortgage application to do this.

With some banks, a full mortgage application is only done when you have signed the contract on a purchase property—which is not possible when going to auction. Lenders like this will only verify your payslips, bank statements and income information when they receive this contract of sale, putting you at risk when going to auction because you can’t be 100% sure they can lend you the money.

At Hunter Galloway we work with several lenders who fully verify your documents before issuing a pre-approval; this makes a much more reliable approval with fewer conditions when you are buying at auction.

What Are Some Common Pre-Approval Conditions?

In most cases, a pre-approval has conditions that need to be completed before the loan can be unconditionally approved. This is quite common and these range from generic conditions like subject to a bank valuation to specific conditions like getting a letter from your employer confirming your start date.

A few common pre-approval conditions include:

- ✅ Our validation of all details provided to ensure they are true and correct

- ✅ Our receipt of all necessary supporting documentation

- ✅ Satisfactory valuation for the proposed security property(s)

- ✅ Lenders mortgage insurance approval, if required

- ✅ No significant change in the customer’s financial position

Aside from understanding you have a reliable pre-approval, it’s important to know what your auction budget should be, what the repayments are going to look like after you’ve bought the property and how much deposit you need.

What to Do Once the Application Is Submitted for a Pre-Approval

Make sure the loan application is in line with the bank’s policy before you submit it. You can seek the advice of a lender or a mortgage broker to make sure it adheres to the policy and ask the following questions:

- Can I make a bid at the auction?

- Am I required to satisfy conditions before going to the auction or making an offer?

- What are the pre-approval conditions?

- Has my application been approved by the lenders mortgage insurer?

- Has my application been accepted by the credit department?

Important reminder: Lending policies and interest rates vary from time to time and are subject to change. So, when you go to an auction, make sure you are aware of the policies and current rates.

Are Pre-Approvals Always Reliable?

First of all, avoid non-written applications or a non-formal application; this includes an application that is submitted over the phone or a quick online application. It is likely that these applications have fewer guarantees and you might end up fulfilling different conditions related to your application at a later date, which will only increase your work.

You are required to submit a formal approval signed by a lender for it to be reliable. This will make it easier for a lender to assess your application. The more conditions you fulfil, the higher your chances are to get a pre-approval.

Make sure the following things are done to be able to secure a home loan pre-approval:

- ✅The lender accepts your loan application after evaluating your financial situation.

- ✅Banks or lenders don’t have to check off too many conditions on the application. If there are things on the application that are yet to be confirmed, ask the bank to confirm it first and then submit your application for approval.

- ✅The pre-approval submitted is for more than what you plan to spend on the property. This way you won’t have to apply for another pre-approval if the budget is revised.

Is There Any Difference Between a Pre-Approval and Conditional Approval?

Pre-approval is not a complete approval in principle. Once the lender receives your application and supporting documents, they’ll evaluate it to confirm if it is in line with their policy. The approval of an application depends on certain conditions; for example, a bank might accept a property as security against the loan.

A mortgage broker can also help you get a pre-approval on your loan if you haven’t finalised any property yet. It’s only valid for 90 days, but you can get an extension by providing certain documents like salary slip, etc.

In some cases, applicants purchase a property before getting a pre-approval. They sign the agreement of purchase and then apply for a loan. But it’s a risky move as you may end up losing your initial deposit paid to buy a property if you are unable to get a loan.

What Is the Difference Between Final Approval (Sometimes Called Unconditional Approval) and Conditional Approval?

Once you fulfil all the conditions, the bank will give you unconditional or final approval. This is the final step in securing a loan. It shows that you are guaranteed to receive a loan and your application has been fully approved. Unconditional approval is only reversed if a lender suspects any fraudulent activity or finds any discrepancy that was missed earlier.

If a private vendor accepts your offer or you win in an auction, you’ll get a grace period of one to three weeks to get your initial deposit and finances in order. During that period, you can check back with your lender to make sure they will honour the contract. Even if you don’t get a grace period, make an inquiry and ask your lender if they will give you approval.

Start again

Start again