Table of Contents

In this article, we will talk about paying off your home loan faster.

Imagine this: you’ve just moved into your dream home and somehow managed to get it just below the asking price, so it feels like a real bargain, and then your first mortgage repayment comes out. Rates are going up, and sure, it stings a little, but you know you’re paying off your home and making steps to owning your home completely. But then you log into your internet banking, you just paid $3,000 to the bank, and less than $500 went towards paying off your home loan! It doesn’t feel great.

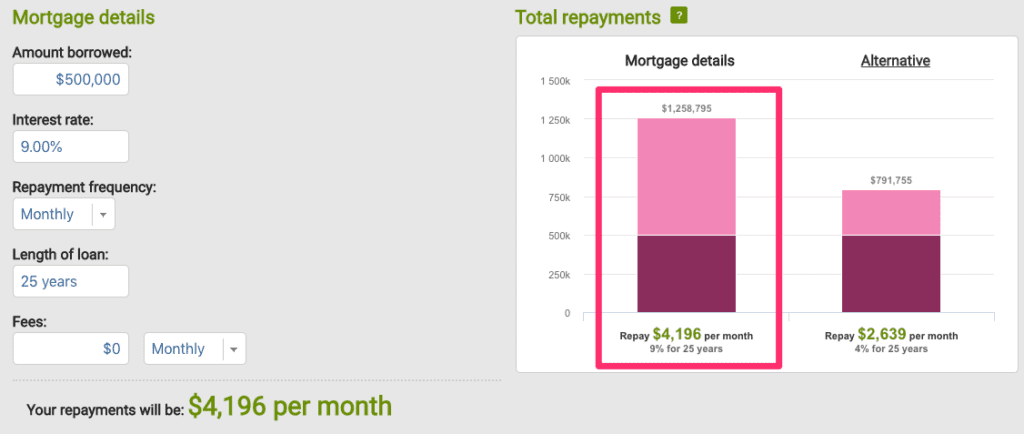

With interest rates where they are today, you’ll be giving a lot of your money to the bank, and most of it will not pay off your loan balance. In fact, for a $500,000 loan over 30 years, you’ll pay over $600,000 in interest.

You’ve probably heard the tip that paying a little bit extra on your mortgage each month will save you a ton. It sounds simple enough, right? But how much truth is there to this, and is it really a magic solution or just a Band-Aid? Today, we’re deep-diving into the world of mortgages, specifically looking at tips to pay off your loan faster.

And if you’re thinking about refinancing, the team here at Hunter Galloway – Mortgage Broker Brisbane are ready to help.

All of these strategies are working GREAT right now.

With the right attitude and guidance, you can be mortgage-free in no time!

Let’s dive in…

How Mortgage Repayments Work

Let’s start by understanding how mortgage repayments are structured. Your mortgage payment isn’t just about paying back the loan. It’s split into two payments: the principal and the interest. Paying off the principal means that you’re paying off the loan balance—the amount you borrowed—whereas the interest goes straight to the banks to line their pockets.

So, how do these work together? When you establish your mortgage, your principal and interest are combined to make up your monthly repayment. So, if you got a $500,000 loan, your monthly repayment will be $3,078, and at the start of the loan, you’ll be spending most of that $3,078 on interest, not on the principal. As time goes on, you start paying off more of the principal, which reduces the interest cost, so more of your $3,078 repayment goes towards paying off your principal.

After 5 years, 22% of your monthly repayments are now going towards the principal, up from 15% in year 1. Assuming the interest rates stay the same, your monthly repayment will remain the same, but you’ll pay less interest over time.

By the time you hit year 19 on a 30-year loan, you’re paying off more principal than interest. After 5 years, you’ll have only paid $33,000 to your principal and $151,000 in interest, and at the end of your 30-year loan term, you’ll have paid over $600,000 in interest to the bank.

For the sake of simplicity, we’re assuming interest rates don’t change. If the rates go up, you’re going to be paying a higher repayment, but generally, the proportions of interest to principal remain more or less the same. The good news is if rates go down, you can keep your payment the same and pay more towards your mortgage.

So, how can you pay off your loan faster and avoid paying more interest? Well, that’s the title of this article, so keep reading…

1. Get the right type of loan

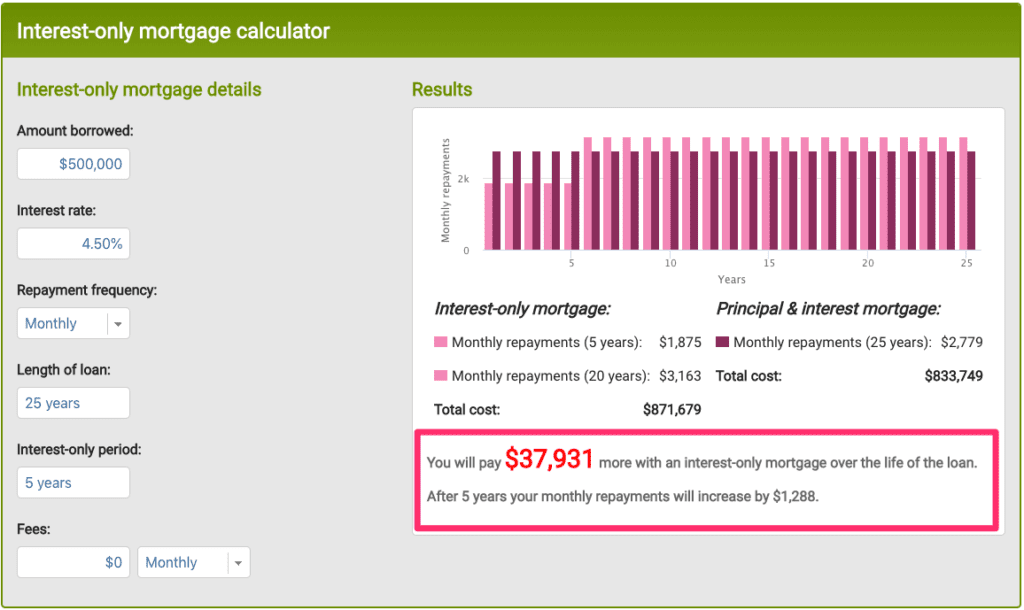

Here’s the deal, before you can even think about paying your home loan off faster, you need to have a home loan type that will allow additional repayments. It’s important to be informed about the different types of loans available, as well as the pros and cons of each.

For example, a fixed-rate home loan only allows a maximum of $10,000 in extra repayments per year.

If you have committed to a long-term fixed rate, you may be stung with penalties as you can’t pay more than $10,000 in extra repayments per annum. This hinders your ability to pay off your loan faster.

This is a huge problem

Fortunately, there’s a simple solution…

…The split rate home loan.

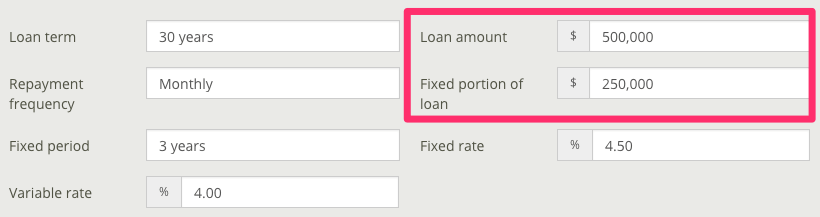

A split rate home loan is a mortgage where one part of the loan has a fixed interest rate, and the other part has a variable interest rate. It gives you the flexibility to pay as much as you like off the variable part and have some certainty when it comes to the fixed loan.

For example, if you have a $500,000 loan, you can split it 50/50. This would mean you have $250,000 in variable and $250,000 fixed. You can split your loan any which way 90/10 or 70/30, or 50/50. The choice of how to split it is ultimately yours.

Step-by-step process to split your home loan:

- Decide how you would like to split your home loan (50/50, 70/30, 80/20, etc.).

- Contact your mortgage broker and let them know you want to split your home loan.

- Complete a variation to split your home loan.

- Double-check with your bank that your 100% offset account is correctly connected to the variable split.

2. Don’t use interest-only repayments

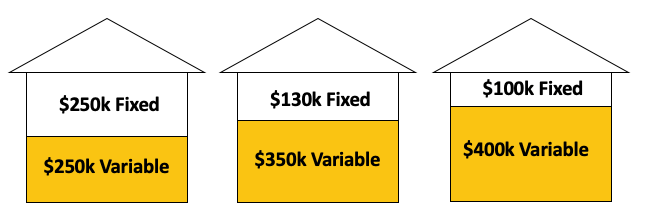

This is a simple strategy that can literally cut $37,931 in additional interest from your loan:

An interest-only home loan allows you to pay only the interest on the loan for a specified time instead of paying both the principal and interest. This means you are not making any progress towards paying off the actual loan but only towards the interest.

Although less common today, many lenders will offer the opportunity to pay interest only on a loan.

Warning: Interest-only loans become very expensive in the long run.

However, there can be certain times when an interest-only loan makes sense—like for constructing a property or even when buying an investment property. The benefits are that you have a lower repayment over the period of time that you’ve got the interest only repayment.

The downside is that it can cost you tens of thousands of dollars, and you won’t pay down any principal on your loan.

Paying principal and interest at the same time makes sure you can get your loan cleared, reducing the effects of compounding interest and repaying your loan much faster.

As Albert Einstein said, “compound interest is the eighth wonder of the world. He who understands it earns it … he who doesn’t… pays it. Compound interest is the most powerful force in the universe.”

3. Act like your loan has a higher interest rate.

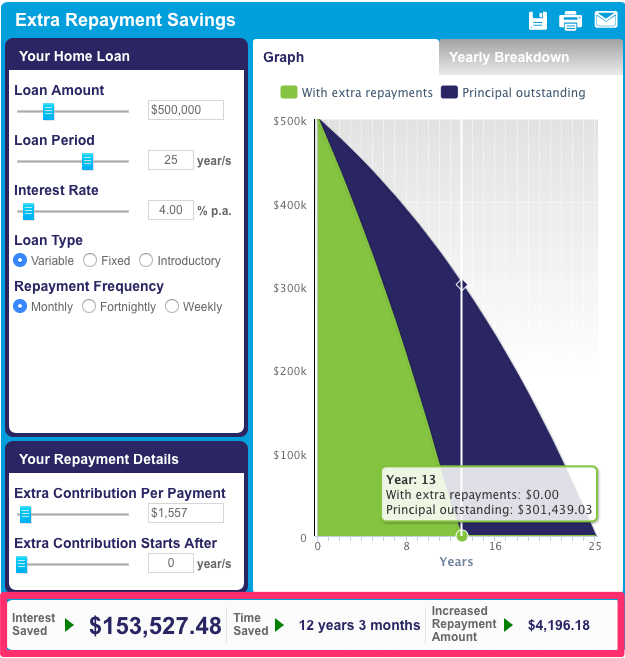

This is one of the BEST ways to pay off your home loan faster. We call it the 2x strategy. In fact, this single strategy can help you pay down your home loan 10 years faster!

Using the ASIC repayment calculator, work out what your repayments would be if interest rates went to 8%.

In my case, they would almost double to $3869 per month, which is an additional $1,557 per month.

This increased repayment would save 12 years from my loan term and reduce interest costs by $153,527.

Yeah, that’s a lot of money.

Another added benefit from this technique is that if interest rates go up in the future, you won’t be caught out because you are already making extra repayments!

4. Make extra lump sum repayments.

They say every cent counts, and it is certainly true when it comes to your mortgage. Paying above regular minimum repayments is a surefire way to pay off your mortgage faster and even gives you the financial freedom to retire early if you want.

The best part is that you don’t need to pay much more to reap the rewards.

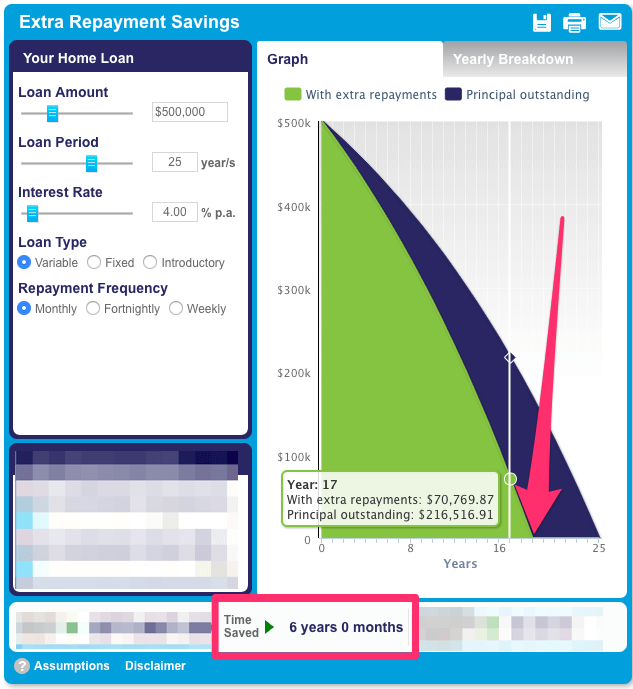

For example, on a 30-year home loan of $500,000, paying only an extra $25 a week or $3.50 per day could see you become mortgage-free 2 years and 3 months ahead of schedule! This might make you think twice before grabbing that cup of coffee next time!

Tax returns or bonuses are a handy source of cash that could help you pay off your home loan sooner. These windfalls are money that you already learned to live without, so it’s unlikely you will miss the money.

Using these windfalls to add to your mortgage will drastically impact your loan balance, which will accelerate the time it’ll take to pay it off. As with the same example we used earlier, on a $500,000 loan, making a lump sum repayment of $10,000 in the second year will cut 10 months off your loan term and save you $12 800. It might even be worth making it an annual habit to use your tax return to pay off your loan.

How much would an extra $1,000 a month impact your mortgage?

Paying an extra 1,000 a month would shave 13.7 years off your mortgage. This means your loan will be fully repaid in 16 years, and that’s going to save you over $300,000 in interest. So, on a $500,000 loan, instead of paying back a total of $1.1 million to the bank — that’s $500,000 in principal and $600,000 in interest, you’re only paying back $800,000. The principle or the amount you borrow remains the same, but you’re knocking down that principle a lot quicker, which means there’s less interest to pay.

The extra $1,000 a month goes straight to the principal. So, looking at your payment, instead of just paying 15% of your principal in year one, you’re paying 38% instead. Since there’s compound interest involved, the effects are also compounded. At the 5-year mark, 50% of your payment goes towards the principal.

We realise money can be tight, and the cost of living is high, so an extra $1,000 might not be achievable with the current rates.

What if you pay just an extra $100 a month towards your mortgage? Even with an extra $100 a month, you’re saving 2 and ½ years and over $60,000 in interest repayments. An extra $500 a month would save you 9.1 years and $212,000 in interest. So, in other words, any extra money you put towards your home loan will save you a lot of money in the long run.

So we’ve crunched the numbers, looked at the scenarios, and seen the undeniable impact extra payments can make on your mortgage. Even an extra little bit each month can make a big difference to the interest you pay over the life of the loan. Not to mention cutting down the time it takes to pay off that loan. Finding that extra cash can be a challenge, with the cost of living being what it is, but the potential savings are really too big to ignore. Whether it’s an extra $100, $500, or 1,000 each month, every little bit helps chop away that principle faster, saving you tens if not hundreds of thousands of dollars.

5. Use a 100% Offset Account.

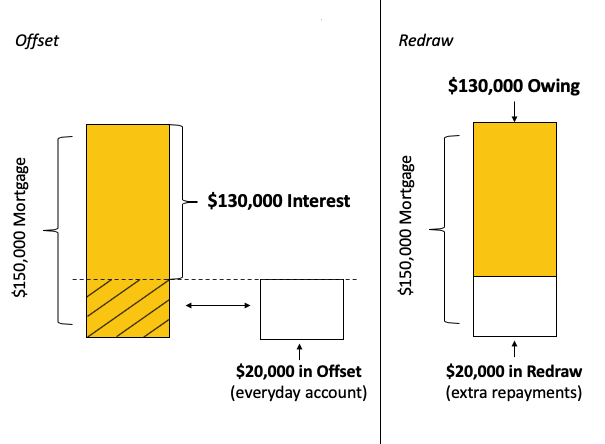

It’s no secret that 100% offset accounts are the best way to pay off your home loan faster.

An offset account is similar to your regular savings or transaction account. It works by only charging you interest on the balance of your home loan minus any money you have in the offset account. Put simply, an offset home loan account allows you to pay off your loan quicker by reducing your interest payments.

You can deposit your pay, gifts, bonuses, and tax refunds into your offset account. Every dollar in the offset account is reducing your home loan balance.

That said, there are still heaps of people who do not fully take advantage of a 100% offset.

As you can see in the example above, every dollar in the offset reduces how much interest is paid on your home loan.

This is also the case if your loan has a redraw facility. The redraw or offset doesn’t even need to be $20,000. It can be as small as $1.

If you aren’t using an offset account, contact your mortgage broker today to look at switching your home loan type or at least check if you have a redraw facility.

Read More: 13 Mistakes nearly all first homebuyers make

6. Get your budget in order

As the saying goes, ‘money is a cruel master but an excellent servant.’ Make your money work for you to its maximum capacity by doing a budget.

Having a budget in order is essential for achieving your financial goals. A budget helps you stay on top of your expenses, so you can use the ‘extra’ money you save to pay down your loan faster.

Half the battle with budgeting is just being aware of what you are spending.

There are many ways you can do this. One of the best ways is to use a budgeting app. Many apps are available, so you can choose the one that suits your needs best.

All you need to do is:

- Download your chosen app

- Insert your bank account feeds

- Let the app start categorising expenses

- Check it regularly to see what you are spending your money on

Read More: 11 Hidden Costs of Buying a Home in Brisbane

7. Check out other banks

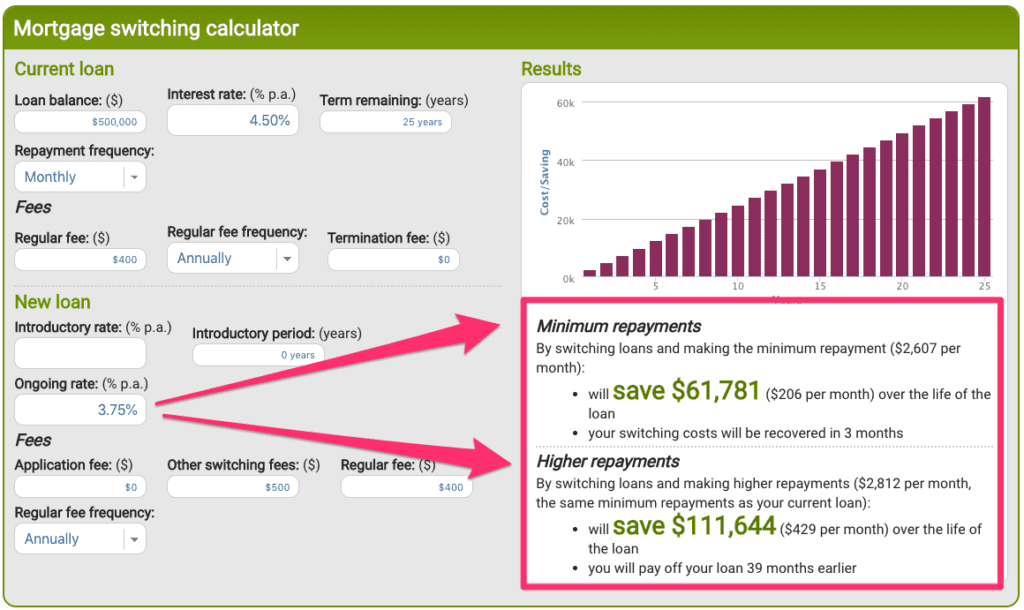

Some banks offer great interest rates for new clients but do not extend these lower rates to existing customers. So if you have been with the same bank for some time, you might be paying a higher interest rate! You can refinance by moving to another lender or refinancing with the existing lender.

Refinancing your loan can cut your interest costs by THOUSANDS.

Does this mean you should go out and refinance your home loan today? No.

Instead, we recommend talking to your mortgage broker to see what deals are available or if your existing bank is willing to reduce your current interest rate.

This strategy works so well that even a small reduction of 0.75% can pay off your home loan 39 months earlier. That’s almost 4 years!!!!!

There are also some banks that offer rebates and cover the fees for switching your home loan.

Read More: 7 reasons to refinance your home loan

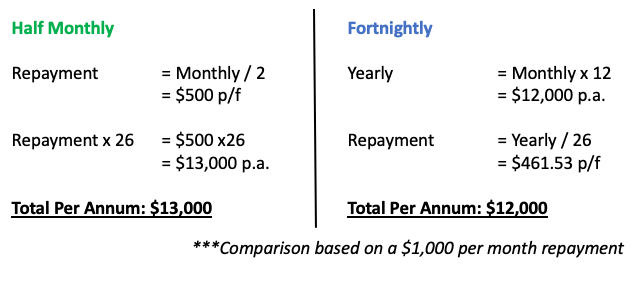

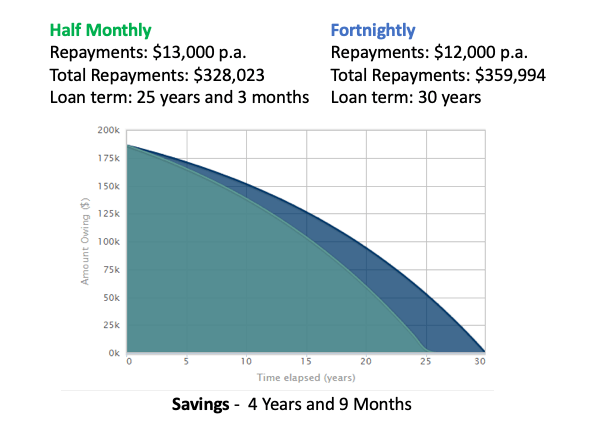

8. Cut up your loan and make fortnightly repayments

This is similar to technique #3 from this guide—Act like your loan has a higher interest rate—but with an important twist.

Instead of just paying extra, you split your existing monthly repayment.

In other words, you divide your monthly payment by 2 and make it each fortnight.

For example:

Let’s assume your minimum monthly repayment is $1,000. Cut this in half to get $500. Then pay $500 every fortnight. In a year, you will make one extra monthly repayment of $1,000

Halving your monthly amount per fortnight means you actually pay 13 monthly repayments per year instead of 12, and this seemingly small amount will effectively reduce your loan by 4 years and 9 months!

9. Don’t add fees to your loan.

Here’s the truth, if you want to get a home loan, you will have to pay some bank fees, which can add up to $500-600 per application. These include

- Loan application/Establishment fees. Some lenders charge on the initial drawdown of your loan.

- Document Preparation fees. Lenders may charge this to prepare your home loan contracts before approval.

- Bank valuation fees. These are usually waived, but they may charge you if you need a valuation.

- Other fees like annual fees! Sneaky annual fees can cost up to $400 per year.

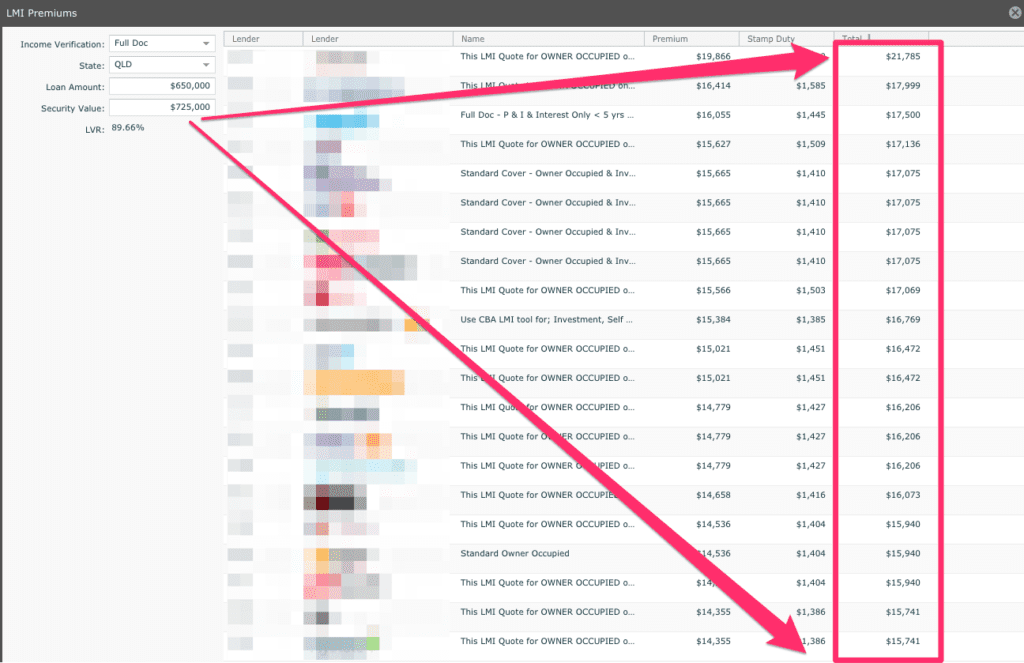

With that being said, the most expensive fee you can pay when getting a loan is Lenders Mortgage Insurance (LMI).

Lenders Mortgage Insurance is a once-off insurance fee that protects the bank (not you) if you default on your loan. It is paid when your loan settles, and sometimes it can be added (or capitalised) to your loan, meaning you don’t pay it upfront, but you pay it over time together with your mortgage.

Lenders Mortgage Insurance can be in the tens of thousands!

The smaller your deposit, the more LMI you’ll pay. On a $600,000 home with a 10% deposit ($60,000), you’ll be asked to pay insurance of around $10,000.

In the example above, $15,741 in lenders mortgage insurance carried over 30 years costs almost double in interest!

While it might not always be possible to pay the lenders mortgage insurance costs upfront, it is worth considering as this can save you a lot of money.

Read More: Lenders Mortgage Insurance calculator

10. Consider non-bank lenders

People love security, so they tend to go with the bigger banks.

But what might surprise you is that the smaller lenders are just as secure as the big banks.

How?

The Australian government’s deposit-taking guarantee.

According to the Australian Securities and Investments (ASIC:), the Australian Government has guaranteed deposits up to $250,000 in Authorised Deposit-taking Institutions (ADIs) such as your bank, building society or credit union. This money is guaranteed if anything happens to the ADI.

What does that mean for you as a borrower? This means you can comfortably get your home loan from smaller lenders knowing that the ASIC guarantees your money.

Smaller non-bank lenders can be a better option for you because they need to compete against the big banks so they can offer you lower interest rates which will enable you to pay off your loan faster.

Read More: Ethical banks in Australia.

11. Think about investing

So you have paid down a big chunk of your home loan. Now what?

It’s time to think about investing.

Keep in mind that investing can be very risky. You should always talk to a professional like a financial adviser first.

If you want to invest in property, consider Rentvesting. Rentvesting is living where you want and investing where you can afford.

Alternatively, you can invest in shares. There are lots of different ways to invest in shares:

- Buying shares directly

- Buying shares using an Exchange Traded Fund (ETC)

- Buying shares using an index-managed fund

- Buying shares using an active fund manager

12. Talk to a professional

If you are uncertain about how to go about any of the steps we mentioned above, then you can contact an expert mortgage broker who will sit down with you and give you the best option that works for you. At Hunter Galloway, we have helped our clients to refinance and get the home loan that suits their financial goals

If you are looking for the best home loan in Brisbane or want to buy a home or refinance, speak with one of our experienced mortgage brokers to walk through the next steps with you.

At Hunter Galloway, we help clients get the best Home Loans in Brisbane in this competitive market. We give you the strategies that have helped other home buyers like you secure a property when there have been 5 other offers on the table!

Enquire online or give us a call on 1300 088 065.

More resources for homebuyers:

Start again

Start again