Are you a physiotherapist looking to buy a home in 2025? There are so many home loan benefits available for physiotherapists. In this ultimate guide to physiotherapist home loans in 2025, we will tell you everything you need to know. In addition, we will show you how working with a mortgage broker in Brisbane can get you into the best deals on the market.

Let’s dive in.

Physiotherapist Home Loan Basics

In this section, we’ll cover the basics of physiotherapist home loans.

First, you’ll see why physiotherapists get certain benefits that other professions don’t.

Then, we’ll show you the different lending options.

What benefits do Physiotherapists get?

Physiotherapists fall within the medical industry and get certain benefits, including waived Lenders Mortgage Insurance. Certain physios may be eligible for discounts when it comes to borrowing.

Some of the benefits include:

- Discounts on interest rates

- Waived LMI (borrow up to 90% of the property value)

- Maximum loan size of $4.5M

- Flexible criteria for new graduates

Why is waived LMI a good deal?

Waived Lenders Mortgage Insurance (LMI) can save you thousands of dollars.

For borrowers with less than a 20% deposit, you usually would have to pay LMI.

However, physiotherapists who fit the criteria will be eligible for waived LMI.

You will also have the ability to borrow up to 90% of the property value.

Unfortunately, only a small number of lenders offer waived LMI to physios.

However, most lenders offer other discounts for physios.

How do I qualify for waived lmi?

Physiotherapists who qualify for no LMI will need to be:

- Working full time

- Fully qualified

- Registered with the Australian Health Practitioner Regulation Agency (AHPRA)

- Able to pay back the loan in line with the bank’s policy.

Are all physios eligible?

To qualify for interest rate discounts and no LMI as a physio, you must be a member of AHPRA and a fully qualified physio working full-time.

You can qualify if you specialise in any of the following fields:

- Geriatric physical therapy

- Integumentary

- Neurological

- Orthopedic

- Pediatric

- Sports

- Women’s health

- Palliative care

How much can I borrow?

This is the key question for anyone who wants to buy a home! How much can you borrow with physio loans?

Get ready for the good news.

If you meet the criteria mentioned above, you can borrow up to 90% of the property value with no LMI.

When it comes to money, you can borrow up to $4.5 million!

How can I maximise my interest rates and discounts?

Physios are lucky because, with this incredible offer, many of you can quickly grow your property portfolio.

The stable income and high income makes physios low-risk borrowers.

Discounts and offers will vary depending on your income and assets, professional status, and how much you want to borrow.

Get a mortgage broker on your side to help negotiate the best offer for you with the lender.

Your investment strategy

If you can purchase your first property with no LMI, this will be a huge help in getting into the property market.

By purchasing a property with a smaller deposit, you can get into the market sooner and save yourself thousands of dollars through waiving LMI.

Then, once you build equity in your first property, you can begin to grow your portfolio.

Case Study: Leah, the Physiotherapist

Leah is a physiotherapist who has been working for the past few years.

She has been renting and only has $45k in savings, but she doesn’t want to have to pay Lenders Mortgage Insurance.

She has found the perfect home for $450,000 and wants to purchase it – but didn’t want to go down the guarantor home loan path.

Solution:

Hunter Galloway was able to source 90% borrowing with no LMI finance for her. Leah was able to borrow $450,000 towards the home purchase with no guarantor.

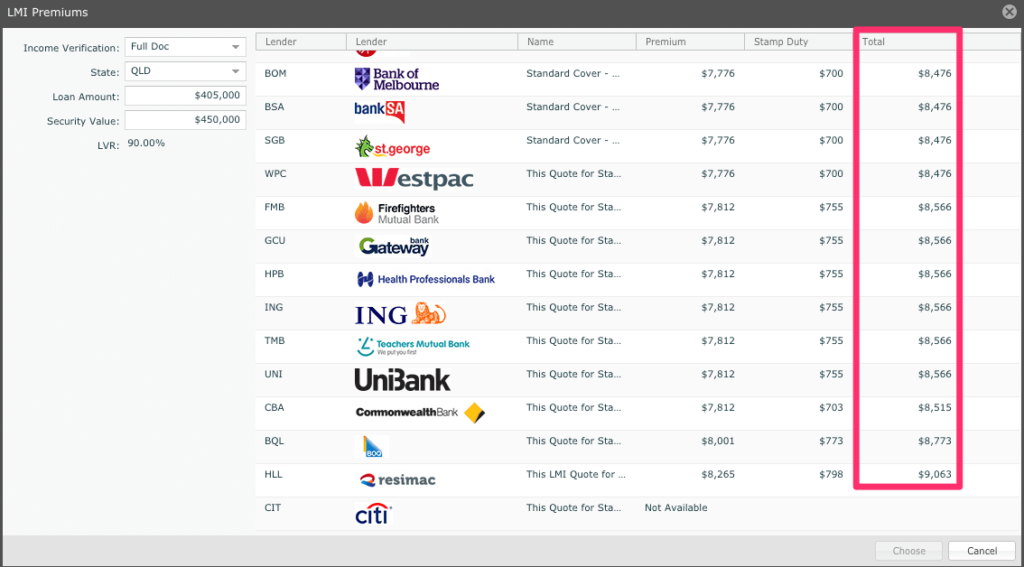

This saved Leah between $8,475 and $9,063 (depending on the lender she would have chosen)! That is a crazy amount of money that was better off in her pocket than the banks!!

If you want to confirm that you qualify to have LMI waived as a physio, get in touch with our team or call us on 1300 088 065.

The Right Lender for You

In this section, we will show you how to choose the best lender for you.

Under the guidance of a mortgage broker, it can be an easy process.

Each lender provides different interest rates and deals. So, it’s essential to do your research.

Let’s take a look.

How do you compare home loans for physios?

While it is possible for you to compare home loans by contacting each bank or visiting their website, we highly recommend speaking to our team or a qualified mortgage broker to get the best deal for you. Some banks have non-advertised interest rates that are only available to mortgage brokers.

However, the key points to look for when choosing a lender are:

- Lenders mortgage insurance: Only specific lenders offer 90% no deposit loans with waived LMI. So, you will need to go through these options carefully. What comes with this benefit is often higher interest rates, too.

- Interest rates: Your interest rates add to your total loan. Often, the lenders that don’t offer waived LMI for physios will provide a discount on interest rates.

- Home loan fees: Watch out for the extra charges added to your loan.

When you are applying for a loan, the bank will assess the following:

- Your deposit size

- Your situation, if it is standard or a unique circumstance.

- The property you are purchasing

- The complexity of the loan

- Your registration with AHPRA

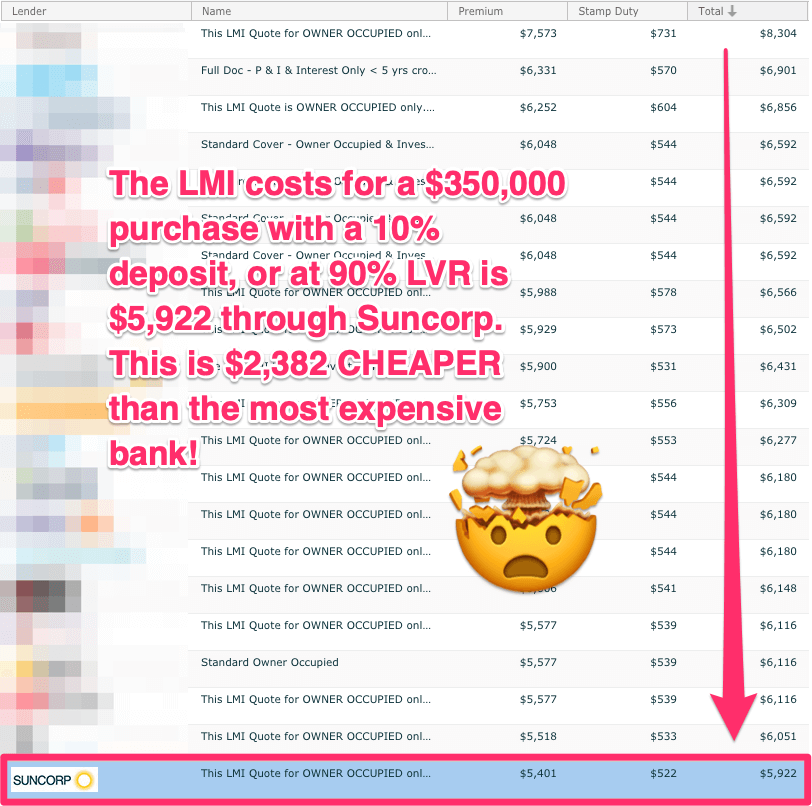

Case Study: How much would I pay in LMI?

If you have a 10% deposit and are looking to purchase a property, you would pay anywhere from $6,800 to $8,141 in Lenders Mortgage Insurance.

Considerations Around Home Loans For Physios

Now it’s time to dive into the pros and cons of physiotherapist home loans and the loopholes.

Let’s take a look.

Are there any other factors that determine if you qualify for waived LMI?

You might be wondering if, aside from income and deposit, there are any other criteria that the banks need you to meet to qualify to have your LMI waived.

There are a few items, including:

- Confirmation of registration with AHPRA

- Confirming your income and personal situation meet the banks’ credit criteria

- The purchase price and type of property you are looking at buying

- If you are purchasing in your personal name or if you are buying in a company or a trust.

If you want to confirm that you qualify to have LMI waived as a physio, get in touch with our team or contact us on 1300 088 065.

What are the pros and cons of home loan benefits for physios?

Let’s take a look at how you can benefit from physio loans and some of the fallbacks.

Pros:

- Discounts on interest rates: Physiotherapists can qualify for interest rate discounts because of their stable income and low-risk status.

- Waived lenders mortgage insurance (LMI): Physiotherapists can borrow up to 90% of the property value without paying LMI.

- Higher borrowing capacity: Physiotherapists may be eligible to borrow up to $4.5 million, depending on the lender.

- Flexible criteria for new graduates: Lenders often have more lenient criteria for physiotherapists who have just completed school. This means quicker loan approvals and quicker getting into the property market faster.

Cons:

- Limited lender options: Very few lenders offer waived LMI or special terms for physiotherapists, which can restrict choices. This is why it is key to work with a mortgage broker.

- Higher interest rates: Some lenders charge higher interest rates for loans with waived LMI.

- Stricter eligibility requirements: Physiotherapists must meet very specific criteria, such as being registered with the Australian Health Practitioner Regulation Agency (AHPRA).

Next Steps And Getting Your Physiotherapist Home Loan.

Are you ready to buy a home as a physiotherapist? Our team at Hunter Galloway is here to help you buy a home in Australia. Unlike other mortgage brokers who are just one-person operations, we have an entire team of experts dedicated to helping make your home loan journey as simple as possible.

If you want to get started, please give us a call on 1300 088 065 or book a free assessment online to see how we can help.

Start again

Start again