Do you want to buy a house using super? In this comprehensive guide, we will walk you through everything you need to know about using super to buy a home in Australia in 2025 using the First Home Super Saver scheme.

We’ll cover eligibility requirements and strategies for making it work with the help of a mortgage broker in Brisbane.

Whether you’re a first home buyer or looking to invest, this article will help you understand how to leverage your super for property purchases.

Quick Summary

- The First Home Super Saver (FHSS) scheme allows first-home buyers to save up to $50,000 in voluntary super contributions for a house deposit.

- Couples can save up to $100,000 combined under the scheme.

- Funds are taxed at a discounted rate of 15% when withdrawn.

- The scheme can potentially save 30% or more compared to standard savings accounts.

- Pros include tax savings and higher interest rates; cons include limited contribution amounts and potential delays in fund release.

- Alternative options for home buyers include getting a guarantor, saving a larger deposit, or buying with a partner/family member.

- Self-Managed Super Funds (SMSF) can be used to buy investment properties but with strict rules and potential risks.

- Using personal loans as a deposit is strongly discouraged due to reduced borrowing power and potential loan rejection.

Can I Use Super To Buy A House?

In this section, we’ll help you figure out if you’re eligible to buy a house with superannuation. So, if you’re not sure if buying a house with super will work for you, this section will get you on the right track. Then, later on, we’ll show you a bunch of advanced strategies and techniques.

What are the features of the FHSS?

Let’s get one thing straight: you can’t technically use your superannuation to buy a house. But, first home buyers are eligible to make voluntary contributions towards their super and use it as a deposit. This strategy is called the First Home Super Saver (FHSS) scheme.

- This scheme allows first home buyers to save up to $50,000 of voluntary contributions overall.

- You can save a maximum of $15,000 per year.

- Another great feature is that couples could save up to $100,000 combined.

- You don’t have to be an Australian resident or citizen for tax purposes to be able to use the scheme!

The scheme can also be used in conjunction with the First Home Owners Grant too.

The main benefit of this scheme is that when you take the money out, it will be taxed at a discounted fixed rate of 15%.

Am I Eligible To Make Voluntary Contributions Towards My Super Deposit?

In order to use the scheme, you should meet ALL of the following requirements:

- You must be 18 years or older.

- You must be a first home buyer. This means you must not have owned property in Australia before including vacant land or commercial property. Your name must be on the title of the property you want to buy.

- You must plan to live in the property within the first year of owning it and be a member of an Australian super fund.

- You don’t have a completed release request in relation to a FHSS determination made in relation to you.

If you have owned a property before, you may still qualify for the scheme, provided you prove that you suffered a FHSS financial hardship.

Using Super For A House Deposit: Does The FHSSS Earn You More Money?

The Government’s FHSSS has estimated that you can save up to 30% or more using the scheme.

For example, someone earning $65,000 per annum and sacrificing $15,000 per year can save up to $25,280 towards a deposit. This is $5,834 (or 30%) more than if you were using a standard savings account.

Differences In Using Super For Low and High Income Earners?

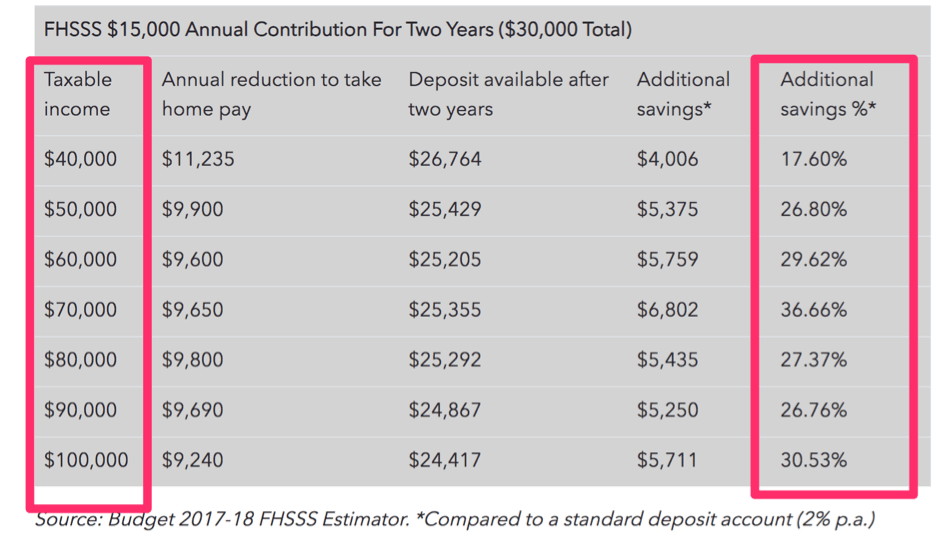

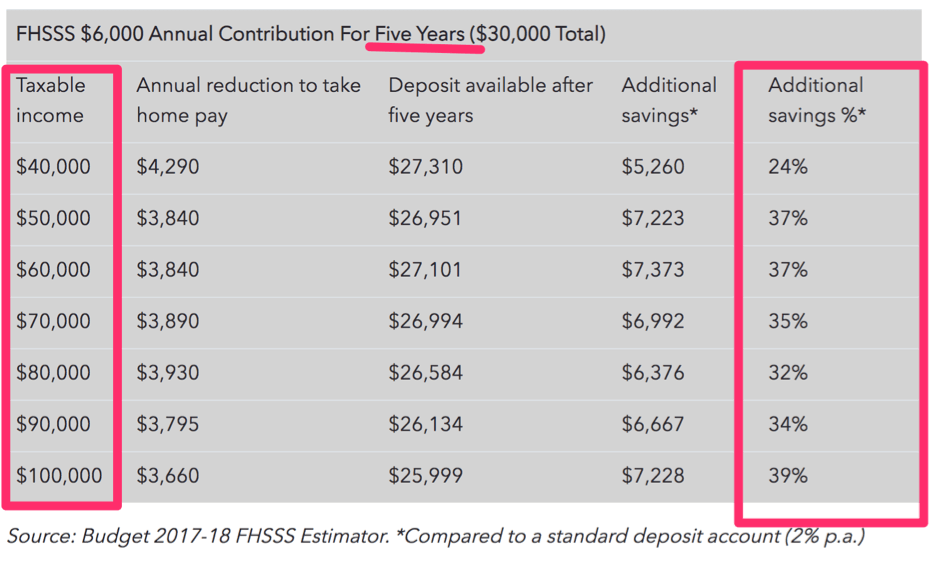

It depends on the timeframe. The difference becomes greater in savings over two years for high-income earners. In the table below, you can see the difference between incomes.

However, smaller long-term contributions for low-income earners have proven to generate better savings and a higher additional savings amount.

How To Request Funds From Super?

First, you’ll need to figure out how much money you have contributed to the fund. When you review your super balance, you can check the total to keep track of the maximum amount you can release ($50k). Once you’re ready to release the funds, you will need to apply for a FHSS determination and release form.

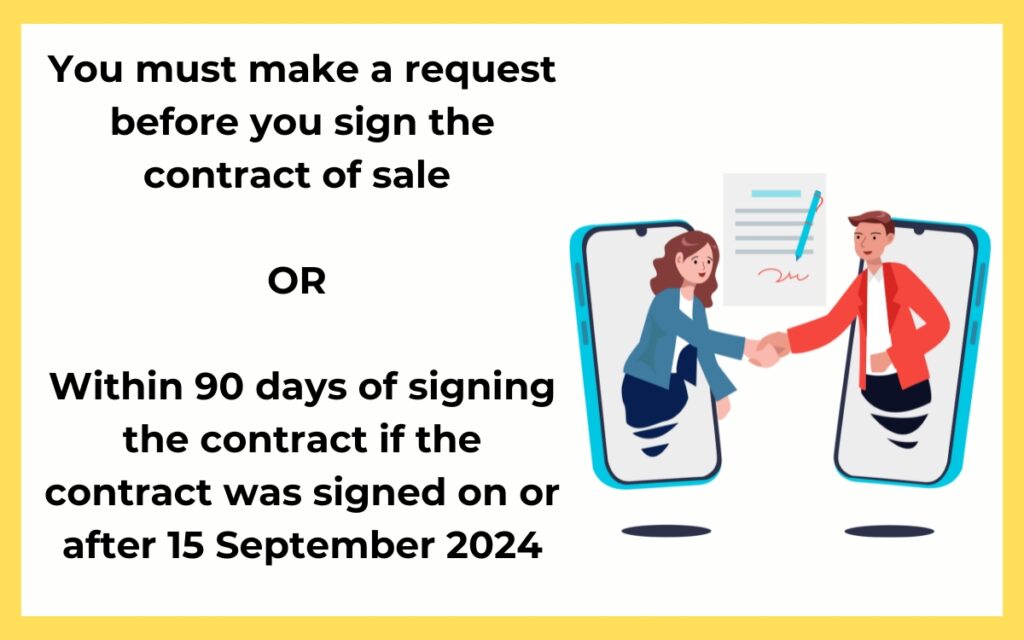

You must make a request before you sign the contract of sale or within 90 days of signing the contract if the contract was signed on or after 15 September 2024. If you miss these time frames you will be subject to the 20% FHSS Tax.

Ensure all your details are correct, as you can only have one active request even if you have requested an amount below what you have in your super.

Wait, what’s an FHSS Determination?

The First Home Super Saver Scheme determination form is what you will need to lodge first. You must apply for and receive an FHSS determination before applying for the funds to be released. After you have an FHSS determination signed, with the signed contract, you cannot request another one. From there, you need to request that your funds be released.

Pros And Cons Of The Scheme

Not every Government scheme is perfect. So, let’s look at the pros and cons of the First Home Super Saver Scheme to give you a clear idea of whether it is for you.

The pros of the First Home Super Saver Scheme

- Save money on tax repayments.

- You can use the scheme as a couple, combining your funds.

- The funds earn SIC rate of 7.38% p.a., which is higher than most savings accounts.

- The amount you can withdraw doesn’t vary with falling markets.

- You will be given a 12-month buffer to purchase a home with the funds after you withdraw the money.

The downsides of the scheme

- It is subject to change in line with government changes.

- You will have less take-home pay as the money will be salary-sacrificed.

- It can be a slow process to release the funds, up to 25 business days. This means you could be at risk of losing your potential dream home.

- If you sign a contract BEFORE releasing the funds, you will need to pay a 20% FHSS tax.

- $50,000 is the maximum a single person can contribute to the fund, which might not be enough for a deposit (if you don’t want to pay LMI).

- Returns are limited to the Shortfall Interest Charge (SIC) rate of 7.38% p.a., which is low compared to other super funds.

If I Can't Use Super As My Deposit, What Other Options Have I Got?

If you are not eligible for the FHSS, don’t despair. Fortunately, there are other options for you to get into the property market. In this section, we will lay out a few different ways you can buy a house sooner rather than later.

1. Get a Guarantor

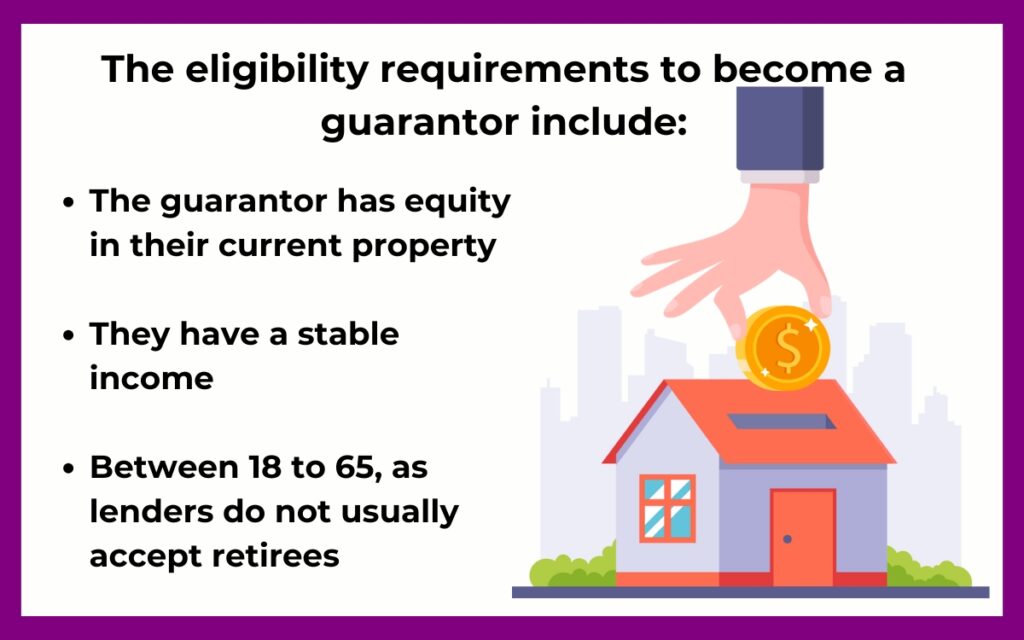

The eligibility requirements to become a guarantor are:

- The guarantor has equity in their current property

- They have a stable income

- Good credit

- Australian citizen

- Between 18 to 65, as lenders do not usually accept retirees

When a guarantor takes on a property with the buyer, they are legally required to pay back the loan if the buyer cannot fulfil repayments. They will need to pay any extra fees or charges, too. The good news is the guarantor can take on just some or part of the loan. So, if this happens, only a portion of the loan will fall back onto them.

If you are in a stable financial position and ready to enter the property market, having a guarantor can be a great way to fast-track this process.

Read more: Guarantor home loans

2. Save a more significant deposit

Sometimes, all you need to do is continue saving and wait a little longer. The more you save, the easier it will be to pay your mortgage and still afford to live comfortably.

A great way to maximise your savings is by starting with your expenses. Do an audit of unnecessary spending. Are you spending money on Uber Eats or AfterPay each week? Time to cut those expenses and replace that money by putting it into savings.

These small changes will help you speed up your savings process.

Read more: How to set a budget for buying a home

3. Buy with a partner or family member

A lot of thought needs to go into this one if you’re planning to buy a property with a partner or family member.

First, ensure you’re on the same page and have clear guidelines for each buyer.

Figure out a contract with ownership over the property, and have an exit strategy should either of you want to sell their half of the property.

You may feel like these steps are unnecessary, but should financial circumstances change, it’s essential to have all of your ducks in a row.

Buying with your partner or family member can be a great way to combine your savings and make the process much more affordable.

Chapter 3: Self-Managed Super Funds – How Do They Work?

Now that you’ve thought about other options for saving, aside from the FHSSS, it’s time to take a look at Self-Managed Super Funds (SMSF).

In this section, we’ll show you how to work with an SMSF and make the most of it.

This section is specifically for property investors.

Self-Managed Super Fund property rules

So, what is a self-managed super fund? It is a private super fund that allows you to manage your retirement savings. SMSF owners have full control over investment decisions and strategies as opposed to a regular super.

You can use a self-managed super fund to buy an investment property. The catch is…. You are not allowed to live in it!

You can buy the property through your SMSF, and the fund can have one to four members.

The members will need to make a decision together about how the super is invested.

What are the SMSF rules?

To buy a property through an SMSF, you must comply with a few rules.

The property must:

- Fulfil the sole purpose test of providing retirement benefits to fund members

- Not be acquired from relatives

- Not be lived in by any members of the fund or related parties of the fund

- Not be rented by a fund member or associated parties of the fund

There is a loophole that allows you to use the super to buy business premises, which you can then use. However, you will have to pay rent to your SMSF at the market rate.

What will it cost to use super for a house deposit?

Buying an investment property through a self-managed super fund will still have the same fees and even some extra charges that could eat into your super balance.

Check with your mortgage broker and lender before going ahead.

Some of the fees incurred include:

- Legal fees

- Stamp duty

- Advice and upfront fees

- Ongoing property management fees

- Bank fees

Key things to remember about SMSF borrowing

This is where things can get a little tricky.

Borrowing or “gearing” your super needs to be implemented in a controlled and strict way.

The conditions to follow are around a ‘limited recourse borrowing arrangement’.

This type of arrangement can only be used when buying a single asset – i.e. residential or commercial property.

If you are ready to commit to a geared investment, consider whether or not the investment is in line with your broader investment strategy.

What are the risks of a geared SMSF property?

- Cash flow – putting money from your SMSF into your loan is required, and you will need to have enough cash flow to maintain this

- Extra costs – SMSF property loans are often more costly and have additional fees compared to standard loans.

- Potential tax loss – The losses on the property cannot be offset against your income outside of the fund.

- No turning back – If you haven’t set up your loan correctly, like documentation and the contract, then turning the arrangement around can be very difficult. Sometimes, it’s not even possible. In this case, you would potentially have to sell the property, which would most likely result in a loss.

- No changes to the property – While the SMSF property loan is being paid off, you cannot make any changes to the property.

Bonus: Using A Personal Loan As A Deposit

As tempting as it can be to get a personal loan and use it as a deposit – don’t do it.

Why?

- Banks nowadays are more diligent about their research, and if they find out you got your deposit from another loan, they will most certainly deny your home loan application.

- Personal loans can significantly reduce your borrowing power. By ‘significant’, we mean hundreds of thousands of dollars.

These days, there are a lot of self-proclaimed social media financial advisors encouraging you to get personal loans and use them as a deposit. As tempting as it may sound, run far, far away from personal loans. Instead, talk to a home loan expert who will help you get the home loan that is right for you.

So, no matter how persuasive the video telling you to get a personal loan is, just don’t do it.

Frequently Asked Questions

The FHSS scheme allows first home buyers to make voluntary contributions to their superannuation fund and later withdraw these contributions to use as a deposit for their first home. It allows savings of up to $50,000 overall, with a maximum of $15,000 per financial year.

The scheme is available to first-home buyers who are members of an Australian super fund and plan to live in the property within the first year of owning it. Both members of a couple can use the scheme, potentially saving up to $100,000 combined.

You can save up to $50,000 of voluntary contributions overall, with a maximum of $15,000 per financial year. Couples can potentially save up to $100,000 combined.

When you withdraw the money from your super fund under the FHSS scheme, it will be taxed at a discounted fixed rate of 15%, which is generally lower than your marginal tax rate.

Yes, the FHSS scheme can be used in conjunction with other first-home buyer assistance programs, such as the First Home Owners Grant

To request funds, you need to apply for a FHSS determination and release form. It's important to have an FHSS determination before signing a contract and to have a valid release request within 90 days of signing the contract.

The pros include tax savings, the ability to use the scheme as a couple, earning a higher interest rate than most savings accounts, and having a 12-month buffer to purchase a home after withdrawing the funds.

The cons include the scheme being subject to government changes, having less take-home pay due to salary sacrificing, a potentially slow process to release funds, and limited returns compared to other super fund investments.

If you sign a contract before releasing the funds, you will need to pay a 20% FHSS tax.

You can't directly use your superannuation to buy an investment property. However, you may be able to do so through a Self-Managed Super Fund (SMSF), subject to strict rules and conditions.

The property must fulfil the sole purpose of providing retirement benefits to fund members, cannot be acquired from relatives, cannot be lived in by fund members or related parties, and cannot be rented by fund members or associated parties.

It's not recommended to use a personal loan as a deposit for a home loan. Banks are likely to deny your home loan application if they discover your deposit came from another loan, and personal loans can significantly reduce your borrowing power.

There is no specific maximum age limit mentioned for the FHSS scheme. However, you must be a first-home buyer and meet other eligibility criteria.

No, you cannot withdraw your entire superannuation balance to buy a house. The FHSS scheme only allows for voluntary contributions up to a certain limit to be withdrawn for this purpose.

If you don't purchase a home within 12 months of releasing the funds (or applying for an extension), you must either recontribute the funds to your super or pay an additional tax.

Generally, the FHSS scheme is for first home buyers. However, the ATO may determine that you qualify for the scheme if you've previously owned property but have suffered financial hardship.

It can take up to 25 business days to release funds under the FHSS scheme, which is important to consider when planning your home purchase timeline.

Yes, you can use the FHSS scheme to buy vacant land on which you intend to build a home.

The scheme can be used to purchase any type of residential property, including houses, apartments, units, or vacant land to build a home. However, the property must be your intended principal place of residence.

Is Using Super To Buy A House Right For You?

If you are looking at using super to buy your house in Brisbane or across Australia, our team at Hunter Galloway can help.

Our service does not cost you anything, as we are paid by the lender when your home loan settles.

To chat about your deposit, lending and investment lending options, book in a time to sit down with us, or feel free to call on 1300 088 065.

Unlike other mortgage brokers who are just one-person operations, we have an entire team of experts dedicated to helping make your home loan journey as simple as possible.

The information on this page is general in nature and should not be considered as advice. Before you act on this information, you must seek independent legal and financial advice.

Start again

Start again